🎯 This Week’s Target: Silver (SLV)

The market is watching jobs data. It should be watching the Supreme Court docket.

A federal appeals court just ruled that the White House overstepped on tariffs — but left them in place until October. Not a footnote. A fuse. Over the last year, companies adjusted entire pricing strategies around those levies. If the court pulls the plug, you don’t get clean disinflation — you get margin panic, cost undercuts, and one nasty reset in forward guidance.

Meanwhile, everyone thinks rate cuts mean steepening and higher long yields. Maybe, if the bond market were a nature reserve — but it’s a policy petting zoo. The Treasury can shorten issuance. The Fed can twist its balance sheet. There are a dozen ways to cap long yields without saying yield curve control. The real game is coordination, not independence.

So we have two consensus trades — steepeners and soft-landing melt-ups — both dancing on legal ice and policy discretion. Not exactly a sturdy floor.

Below, as always, the rest of what’s cooking:

The $23 Trillion Savings Cannon

Chinese households parked $23T in bank deposits; flows are starting to rotate into equities as policy leans supportive. Hedge funds are chasing China tech and broad EM again. This is less earnings comeback and more state‑engineered wealth effect — great while the music plays, fragile if fundamentals lag.

Multipolarity With Cash Flows

The Xi–Modi–Putin embrace at the SCO summit was a signal about sanction workarounds, energy routing, and gradual dollar diversification. Add U.S. tariff pressure on India and you get a messy, path‑dependent ally map. Multipolarity doesn’t kill the dollar — but it does reroute where disinflation and demand come from.

Dividends Bigger Than Dreams When Capex Runs Hot

Mega‑tech capex and power costs are climbing into a slower growth tape. Quiet compounders with fat, defensible dividends have outperformed more than the narrative admits. In fiscal dominance, businesses that return cash can beat those that merely promise it.

The Week: Data, Dockets, and Optionality

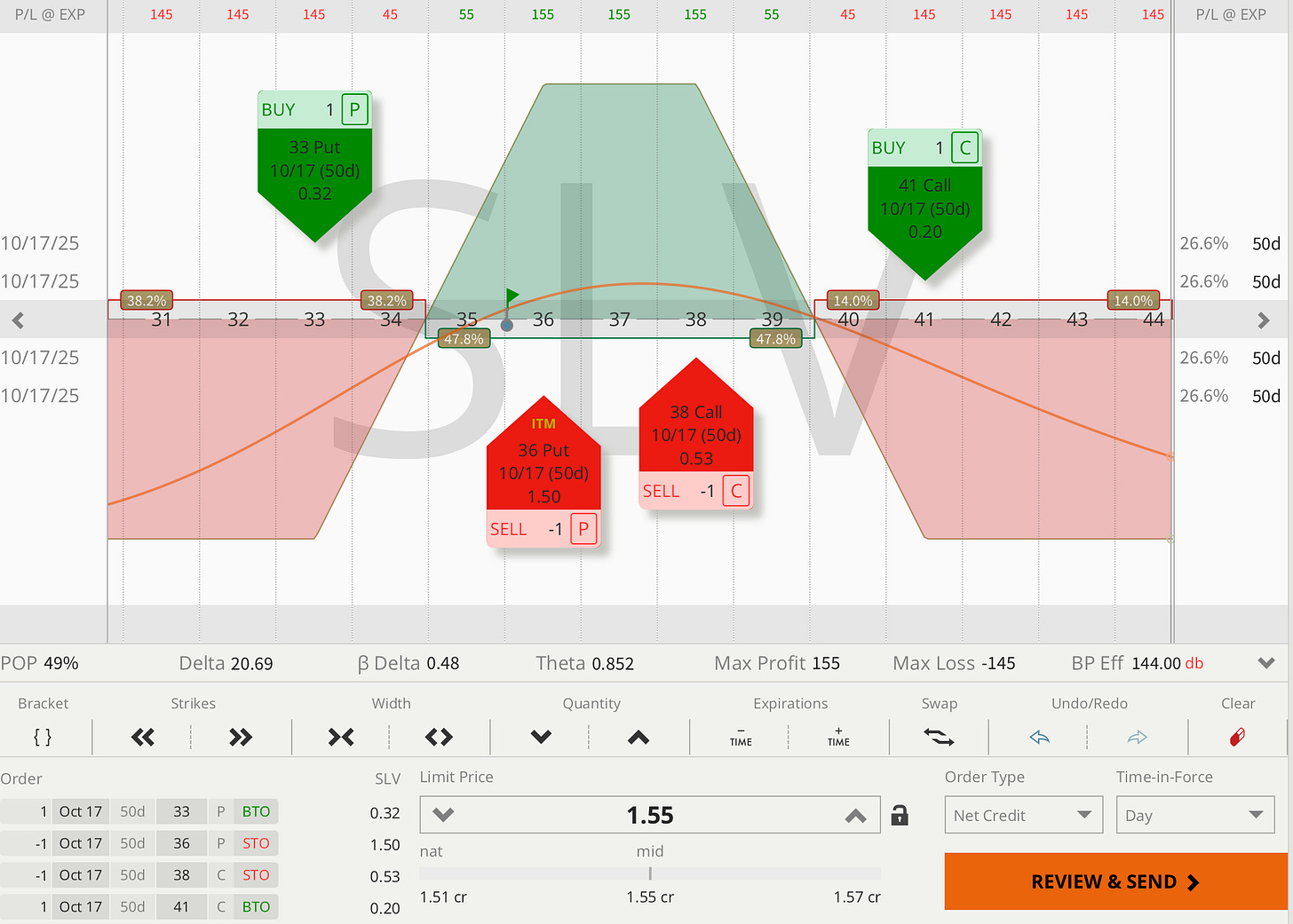

ISM, JOLTS, ADP, and Friday payrolls, plus Fed speakers before blackout. The tariff case now has a court‑driven calendar into mid‑October. With CTAs maxed and vol cheap, this is prime time to own downside optionality on crowded growth — think defined‑risk put spreads or bearish condors rather than naked shorts.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: Silver (SLV)

Bullish on Silver — clearly breaking out. Same thesis as before: dual play on AI/tech-driven demand and inflation hedge.

Want these trade ideas in real time? Become an Elite Trader.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $120 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.