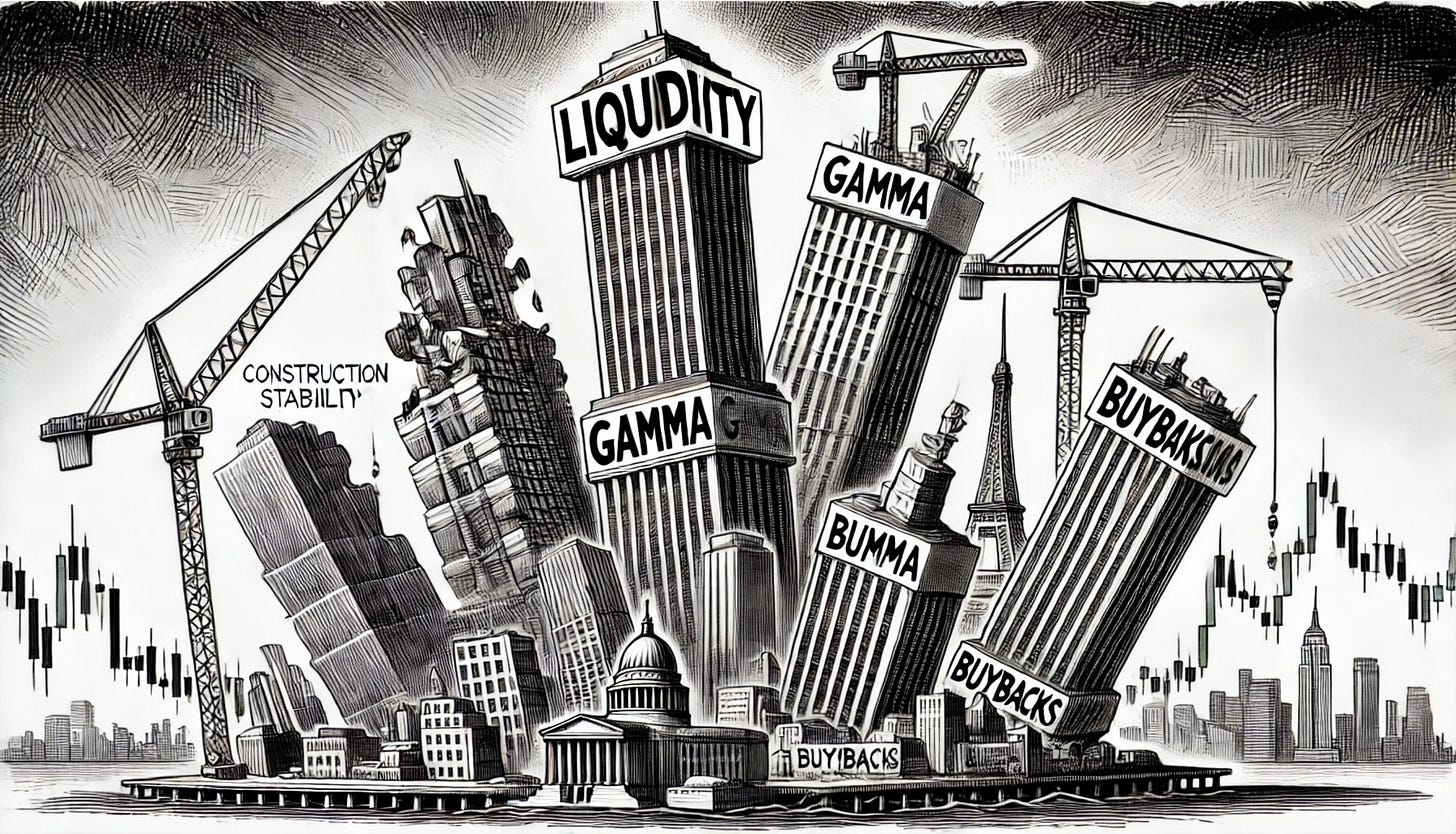

The Quiet Power of Liquidity

In a world where market moves dominate the headlines, the subtle but powerful influence of liquidity often goes unnoticed. Right now, the Federal Reserve is quietly boosting liquidity, providing a critical cushion that's helping stocks stay afloat as concerns about recession and correction swirl. This liquidity isn't just a background factor - it's the foundation on which current market stability rests. When we understand this, we can see why the market hasn't completely buckled under recent pressure.

Greedy Gamma: Sharper Moves

While liquidity provides stability, falling gamma roils the waters. As gamma moves into negative territory, market dynamics shift, making sharp moves in either direction more likely. When Gamma is negative, market makers tend to sell on weakness and buy on strength, which increases volatility. This doesn't necessarily mean that the market is headed lower; it just means that we can expect more dramatic swings, both up and down.

Buybacks to the Rescue?

As we move through the volatile waters of negative gamma, corporate America is stepping in with a powerful counterforce: buybacks. With over 90% of companies now in their buyback window, these repurchases provide tangible support to the market. This isn't just a corporate gesture; it's a calculated move to stabilize and potentially drive stock prices higher. Combined with the increasing liquidity, these buybacks may be just what's needed to counteract the heightened volatility and set the stage for a market rebound.

Become Rich Overnight with Options? Yeah Right…

TUESDAY TARGET: Check out our latest trades in the Subscriber Chat. All bouncing back hard towards maximum profit.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.