🎯 This Week’s Target: Apple (AAPL)

We were told tariffs would torch inflation. Instead, foreign producers are cutting prices to keep U.S. shelf space, services are easing with a softer labor market, and a hot 0.3% core print would be more noise than regime shift. The economy is slowing; that’s the part that matters for the Fed.

Meanwhile, Washington discovered a new business model: border tolls and licenses. Tariffs feed the Treasury, special export permissions come with a revenue share, and the bill lands in someone else’s margin, currency, or capex — not your grocery cart. That’s a transfer, not an inflation engine.

Markets love transfers until they threaten the favorites. Indexes float on the narrowest leadership in decades while hedge funds are shorting small caps aggressively. One merely not‑bad CPI, and the pain trade is a rotation — beaten‑up small caps and lower‑quality balance sheets can rip while the market favorites finally exhale, and the cut narrative survives because the labor side demands it.

Heretical take for the week: foreign margins are funding domestic easing. You don’t have to like it. You do have to trade it.

Below, as always, the rest of what’s cooking:

AI’s Bottleneck Is Power, Not Models

GPT‑5 headlines keep chips center stage, but the scarce input is electrons. Hyperscaler capex keeps climbing, utilities/IPP narratives keep firming, and the grid becomes the new semis. Owning the meter beats guessing the model.

Chip Sales as a Toll Road

Licenses to sell into China now come with a cut‑of‑revenues to Uncle Sam. It’s policy‑as‑platform: firms keep access, Treasury clips the ticket, and the cost bypasses the CPI basket. Expect more bespoke tolls across strategic sectors.

Tokyo’s Tab for Tariffs

Japanese automakers are absorbing a multi‑trillion‑yen profit hit while inching U.S. sticker prices higher at the risk of demand. A live case study in tariff pass‑through: offshore margins erode before American CPI takes the blame.

Crypto: Adult Vol, Teenage Momentum

Bitcoin’s 90‑day vol has slid toward grown‑up asset territory while ETH squeezes on flow. If you like the theme but not the chase, structured upside (bullish condors, call spreads, etc.) makes more sense than naked FOMO.

Get Rich Overnight with Options? Yeah Right...

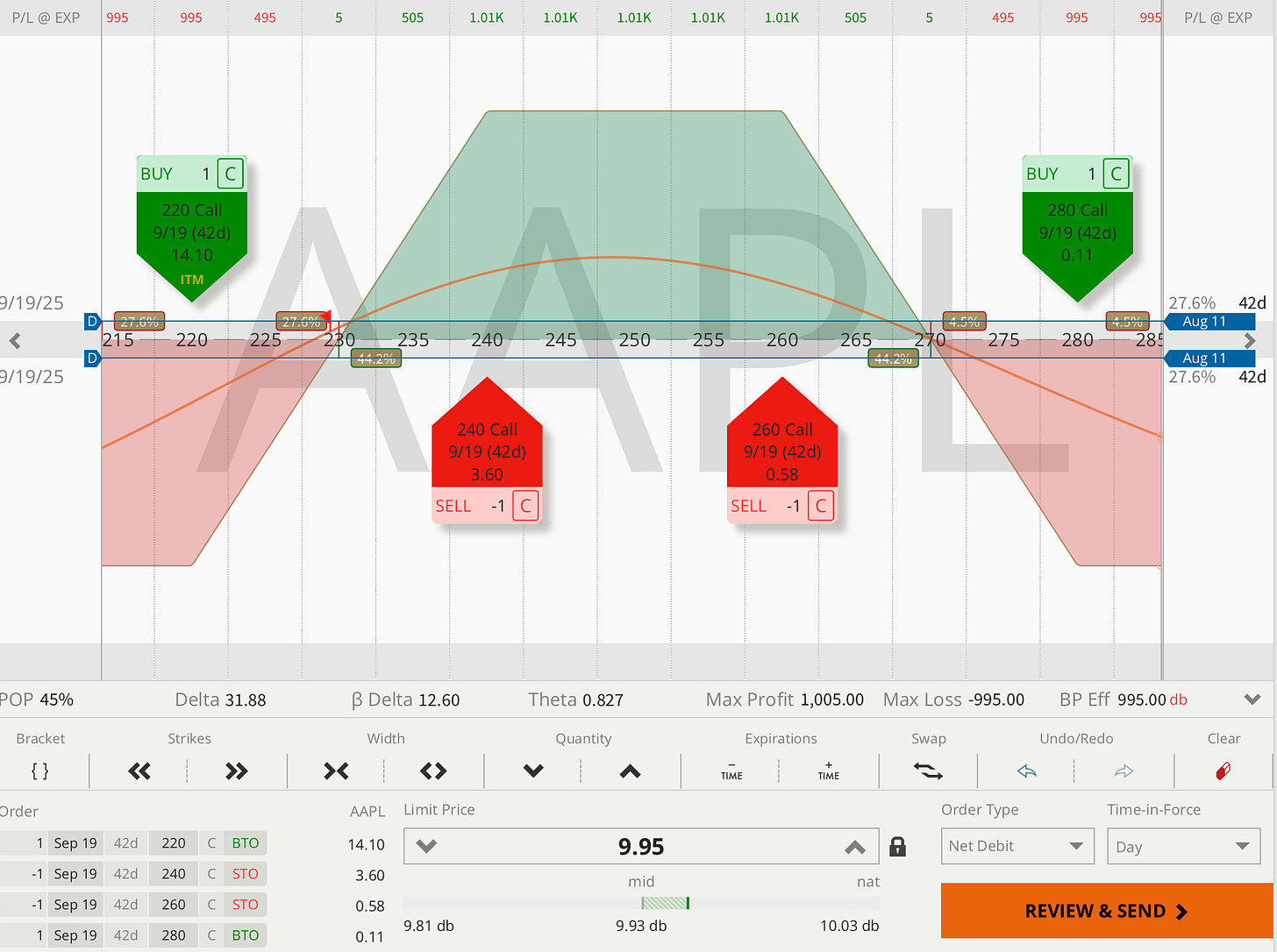

TUESDAY TARGET: Apple Inc (AAPL)

When you commit $600B to U.S. investment and quietly keep the buyback engine running, it gets our attention. Taking a full-on bullish position to see how it plays out. The only Big Tech name that hasn’t had its 2025 sugar rush yet — let’s catch up.

If the portfolio starts getting crowded, think about putting on the SPY hedge. Check with me before pulling any triggers here.

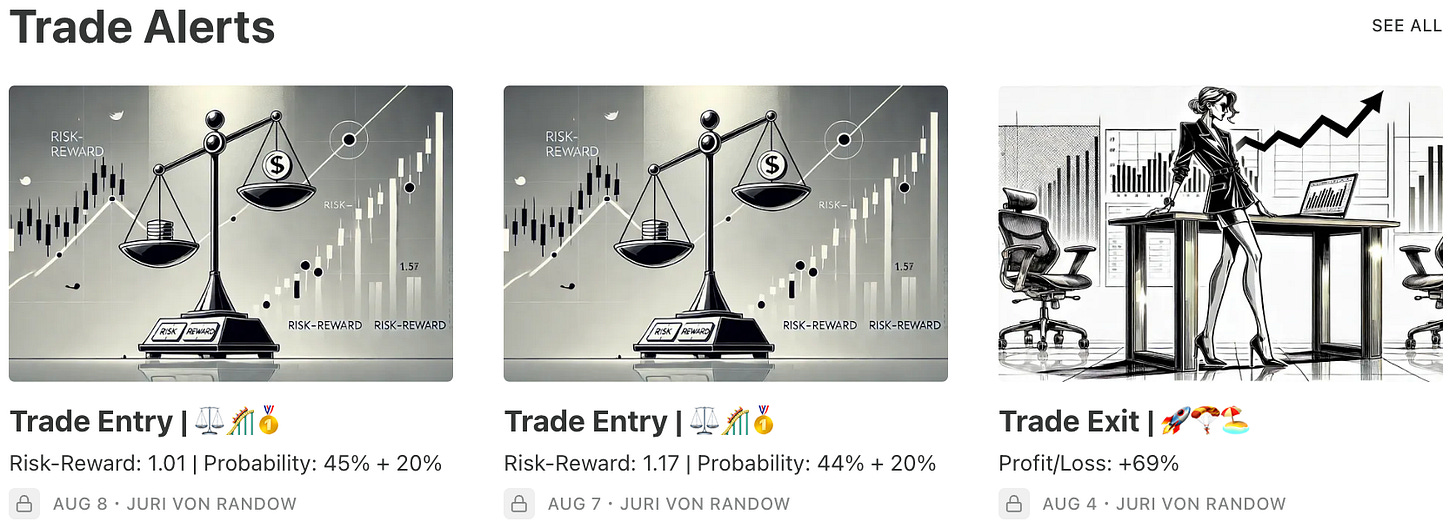

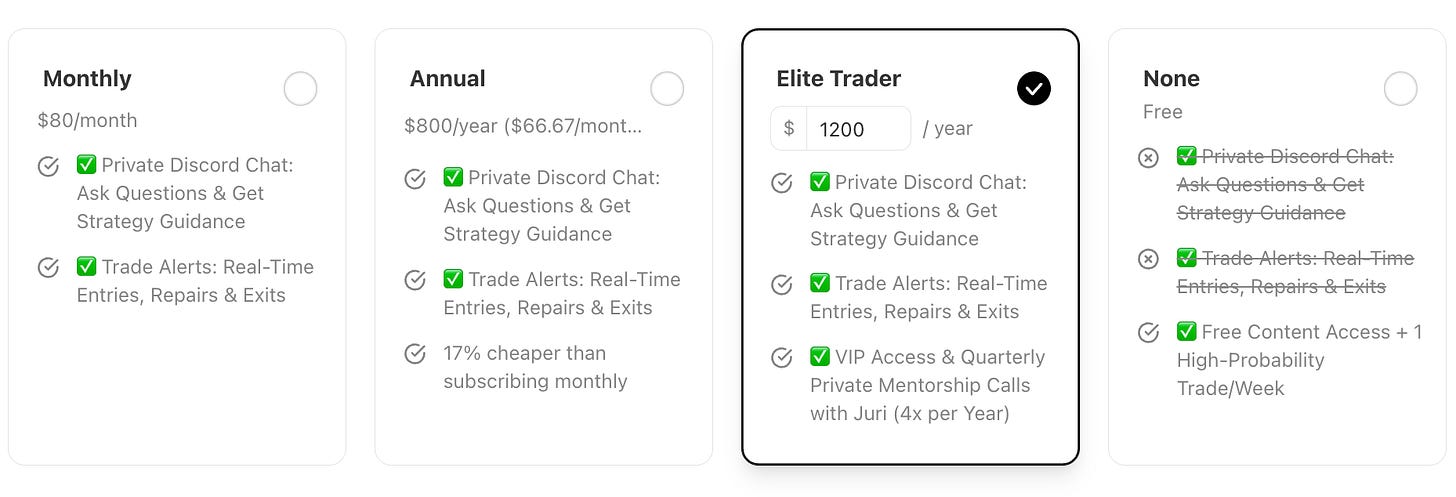

Want these trade ideas instantly? Become an Elite Trader.

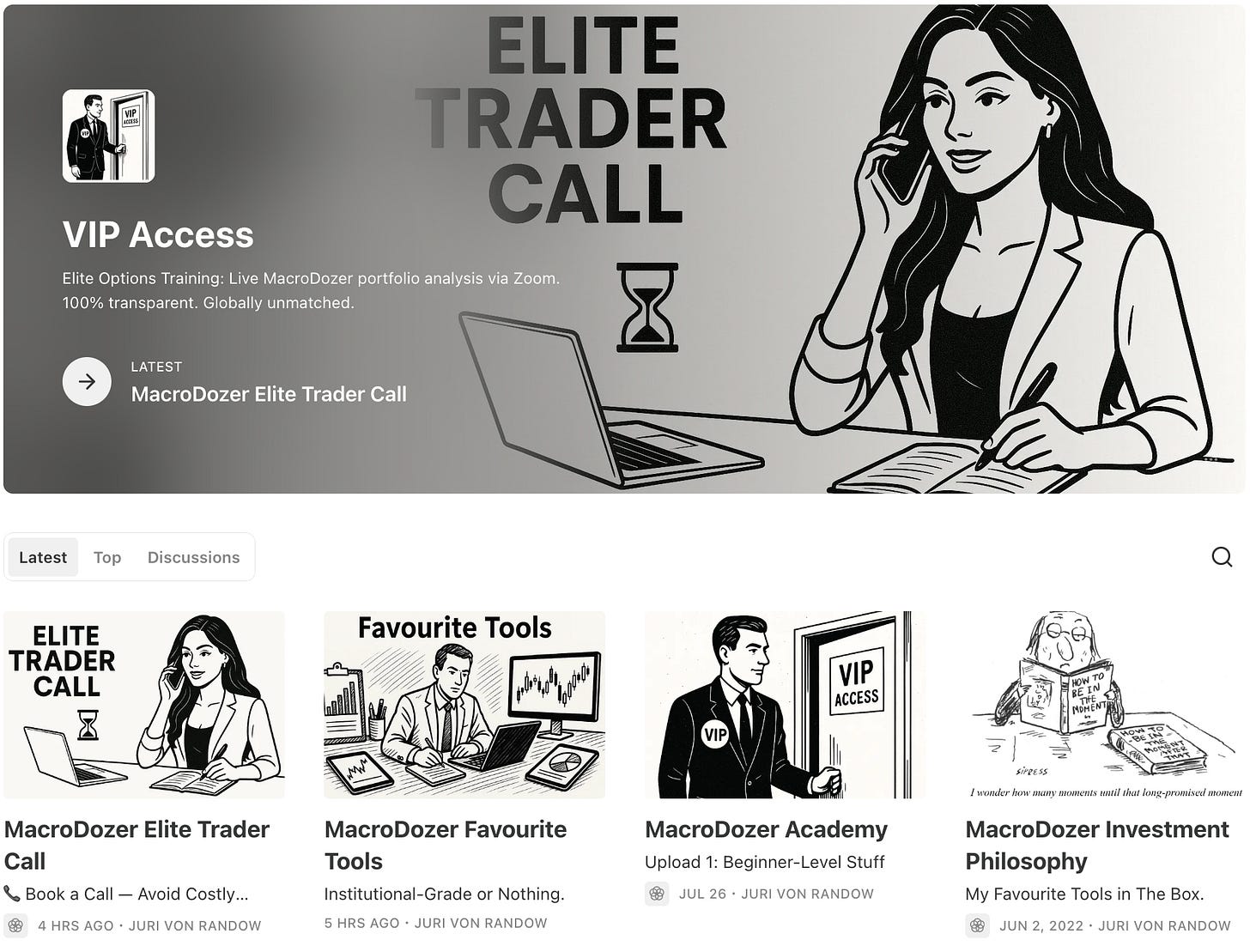

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

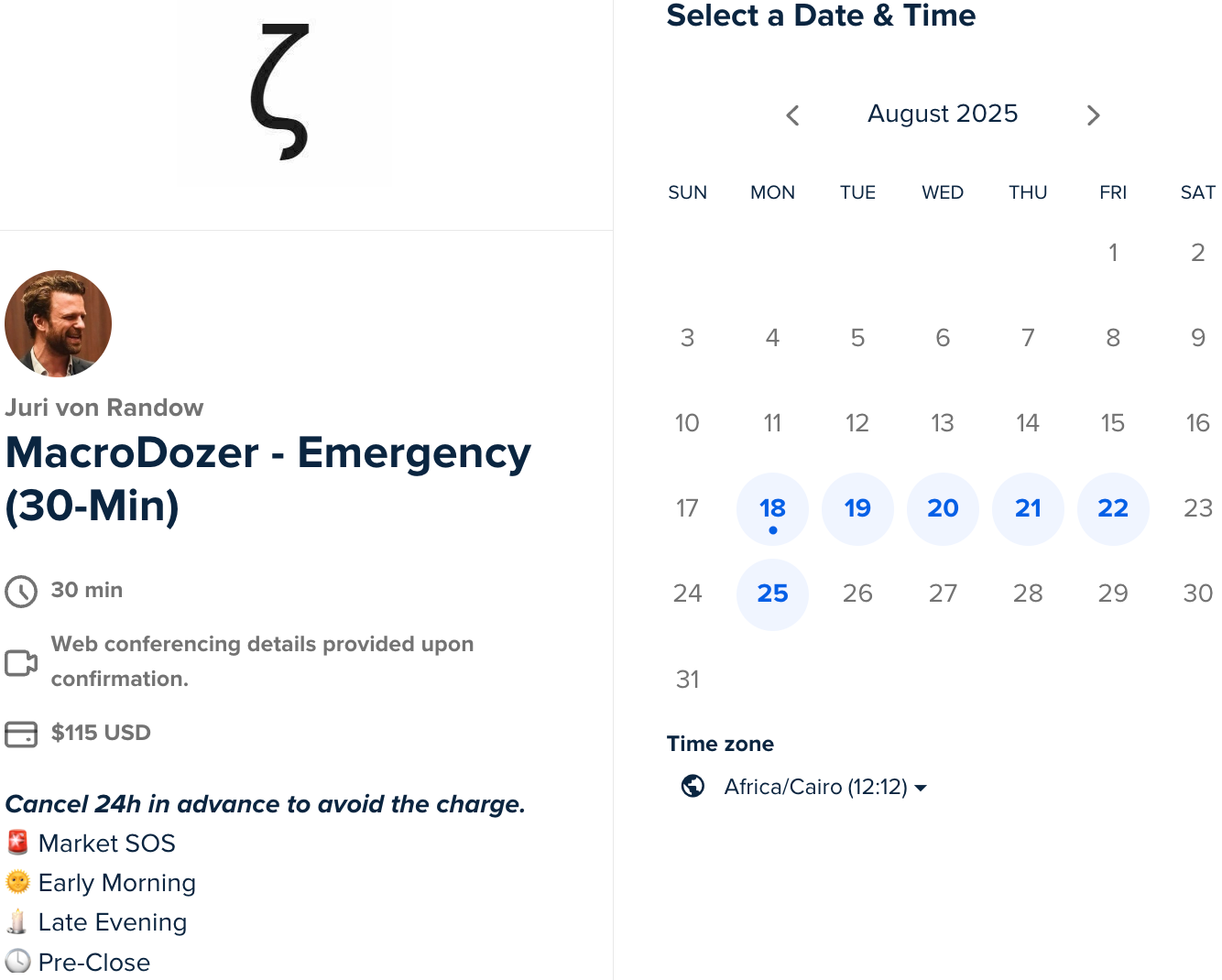

📌 1:1 Mentorship Call

A 60-minute Zoom to master your strategy fast.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

🕓 Pre-Close

📌 Choose Your Access

Free Access 👉 $0/month

✅ Weekly high-probability trade idea

✅ Educational content

❌ No alerts or chat access

MacroDozer Pro 👉 $67/month

✅ Real-Time Trade Alerts

✅ Private Discord Chat with Juri

❌ No VIP Access

Elite Trader 👉 $1200/year

✅ Everything in Pro

✅ VIP Access (Live Replays)

✅ 1:1 Zoom Calls — up to 8/year

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.