Student‑loan delinquencies just spiked to 12.9 %, the worst print in two decades, and the Street’s reaction was a collective shrug. Headlines framed it as a normalization. Normal, apparently, now means one in eight borrowers skipping payments the moment the moratorium expired. It also means $1.64 trillion in IOUs drifting toward default while strategists debate whether September’s cut is 25 or 50 basis points. Priorities, right?

Here’s the disconnect: credit stress never travels alone. Card balances are already at a record, auto loans are wobbling, and HELOC taps — the suburban piggy‑banks of last resort — keep rising. Layer tariffs on top (a stealth sales‑tax running 15‑35 % on half the import basket) and you’ve scripted the fastest squeeze on discretionary cash since 2008. Consumption — 70 % of GDP — doesn’t fall off a cliff; it suffers a series of silent strokes. This was stroke number one.

Now zoom out to the positioning grid. Systematic strategies spent the summer binge‑buying momentum: CTAs, vol‑control, even the risk‑parity crowd now sit in the 90th+ percentile for equity exposure. Call it the Great Auto‑Pilot Rally — powered less by conviction than by declining realized vol. The same models flip to sell on a VIX pop or a single earnings‑revision cycle. What triggers that pop? A consumer‑spending air pocket nobody modeled because delinquency data hits with a quarter‑lag.

The Fed can — and will — ease. But cheaper money can’t resurrect payments that never arrive, nor can it refill the CTA ammo box. When forced sellers meet maxed‑out buyers, bids vanish faster than a congressional budget projection.

No problem with chasing the AI dream. Just understand the margin clerk’s dream could be bigger — and he’s watching the same delinquency chart you are.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

Tariff Math: A $600 Bn Shadow Fiscal Drag

With the White House settling on 15–35 % duties for a widening list of goods, the effective annual tax take lands between $500bn and $650 bn — roughly a third of 2024 corporate profits. Import prices aren’t falling, so the burden hits U.S. consumers and margins.

Data Credibility Premium

The abrupt dismissal of the BLS commissioner after the payroll revision puts a spotlight on statistical integrity. Markets will start cross‑checking hard data (rail volumes, electricity load, card spending) against official prints.

Treasury’s Cash Refill = Liquidity Headwind

The TGA target of $850 bn by end‑September implies a $480 bn drain. With only ~$200 bn left in the Fed’s reverse‑repo trough, the balance must come from bank reserves or money‑fund assets — both tighten financial conditions even before QT.

Earnings Beats No Longer Buy You Much

Q2 beats are outperforming by just 55 bps versus a norm of 100 bps, while misses underperform by almost double. With analyst expectations already sand‑bagged, incremental upside gets scant reward.

Healthcare: The Value‑Growth Orphan

Positioning in large‑cap healthcare sits in the 8th percentile even though the sector offers double‑digit EPS growth at a sub‑market multiple. If cyclicals wobble on consumer weakness, capital will hunt for defensive earnings.

Get Rich Overnight with Options? Yeah Right...

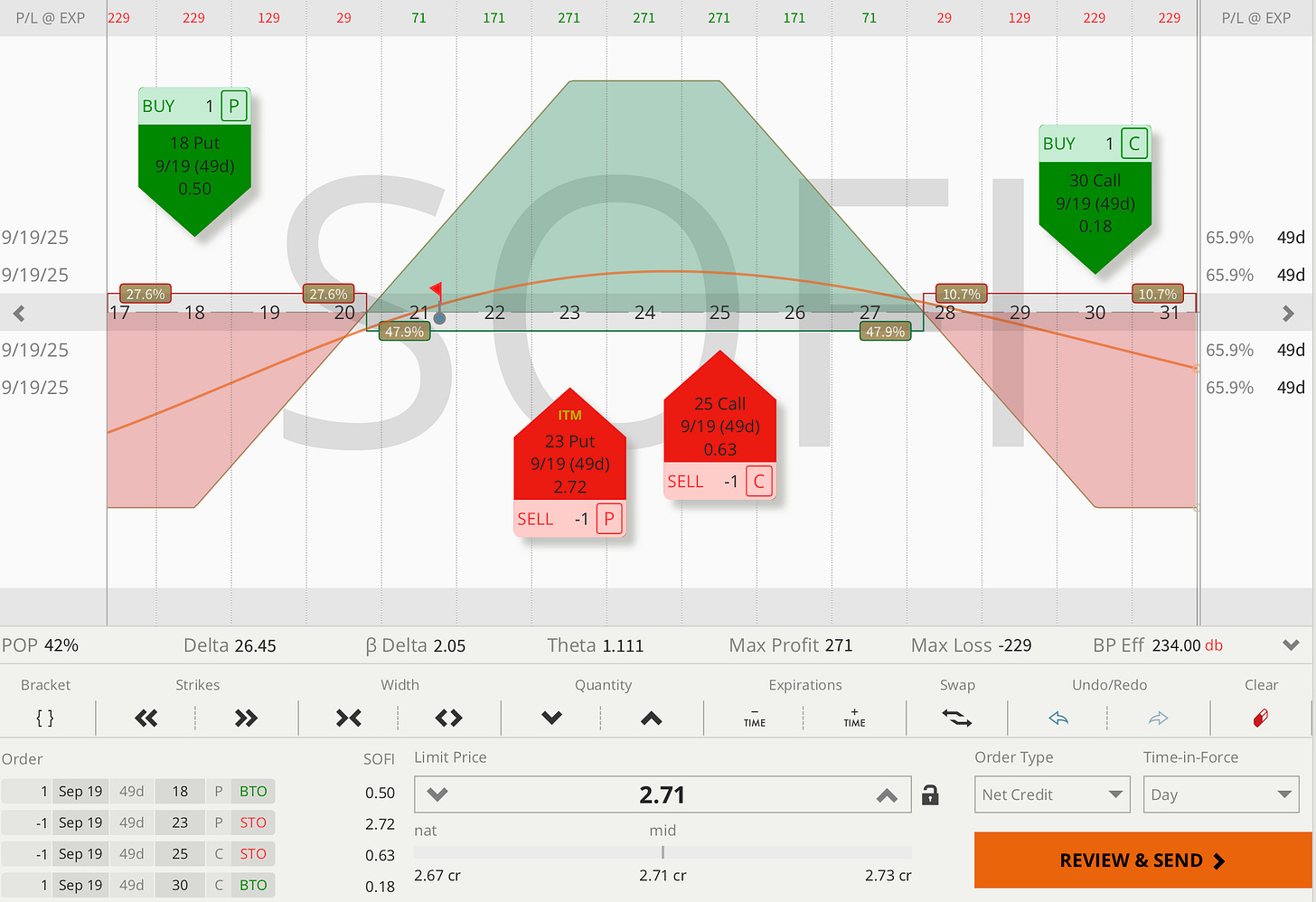

TUESDAY TARGET: SoFi Technologies (SOFI)

Who wants to buy the dip now…? Do we believe in the mid-term positive share price development of this hyper-hyped asset? We don’t have to. It can go up, sideways, or even a little down — we make money all ways, as long as it doesn’t do anything abnormal.

That said, abnormal is the norm for SoFi these days… so we should be fine. ;-)

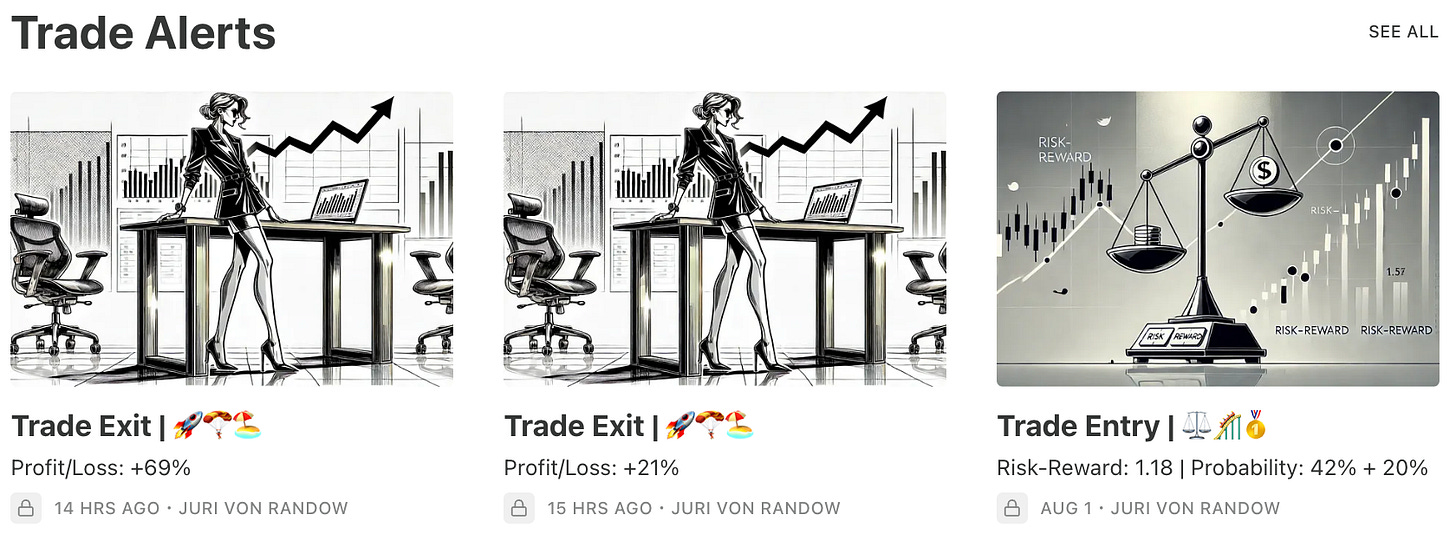

Want these trade ideas instantly? Become an Elite Trader and check out the Trade Alerts.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

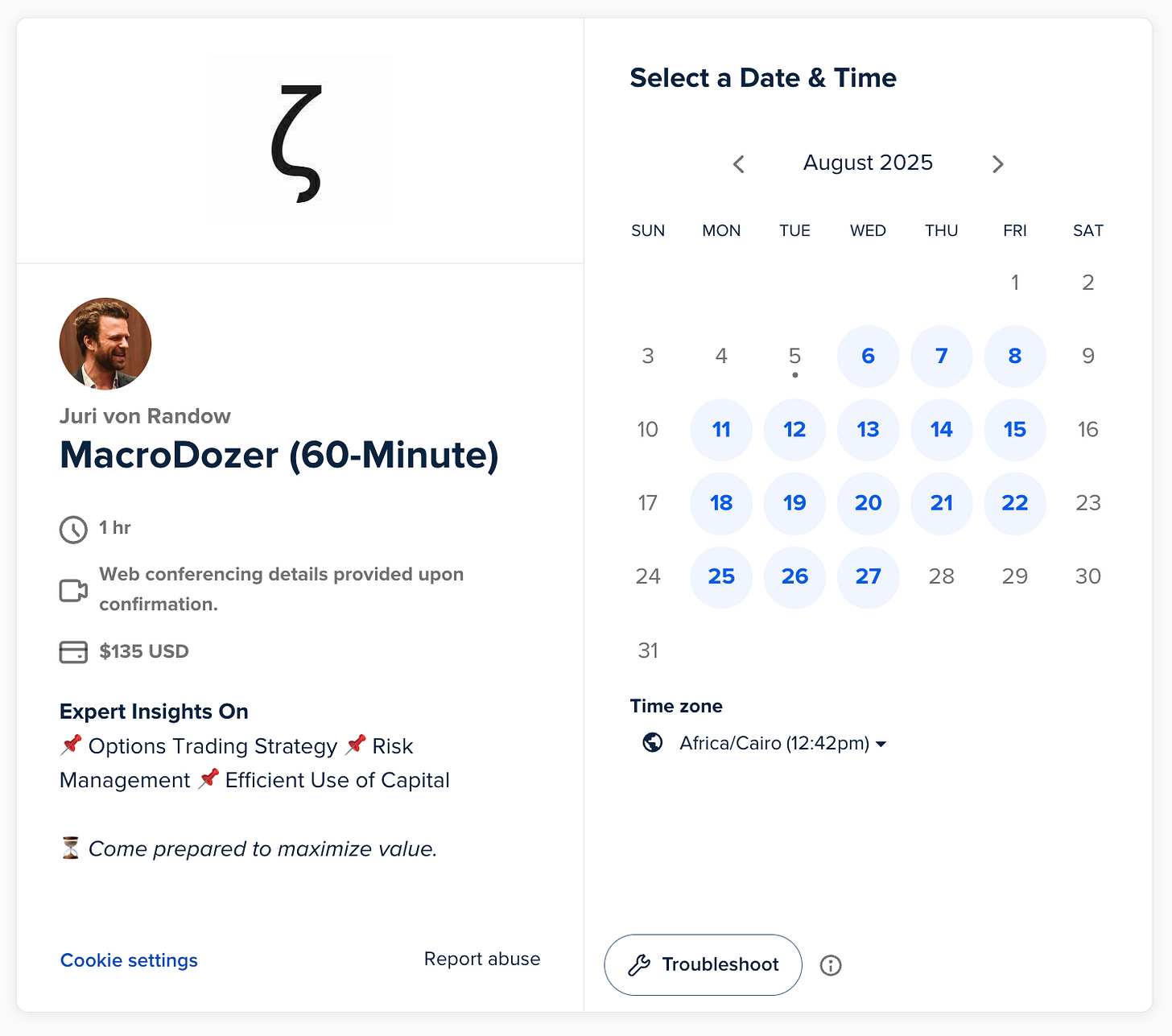

📌 1:1 Mentorship Call

Book a 60-minute Zoom session to master your strategy fast.

Ask anything — options, capital, risk

Tailored feedback on your trades

Built for serious traders ready to accelerate

📌 Emergency Call

For urgent trade issues, market stress, or timing-critical decisions.

Market crash? Last-minute setup?

Get clear, educational guidance — no fluff

Available pre-close, late nights, and early mornings

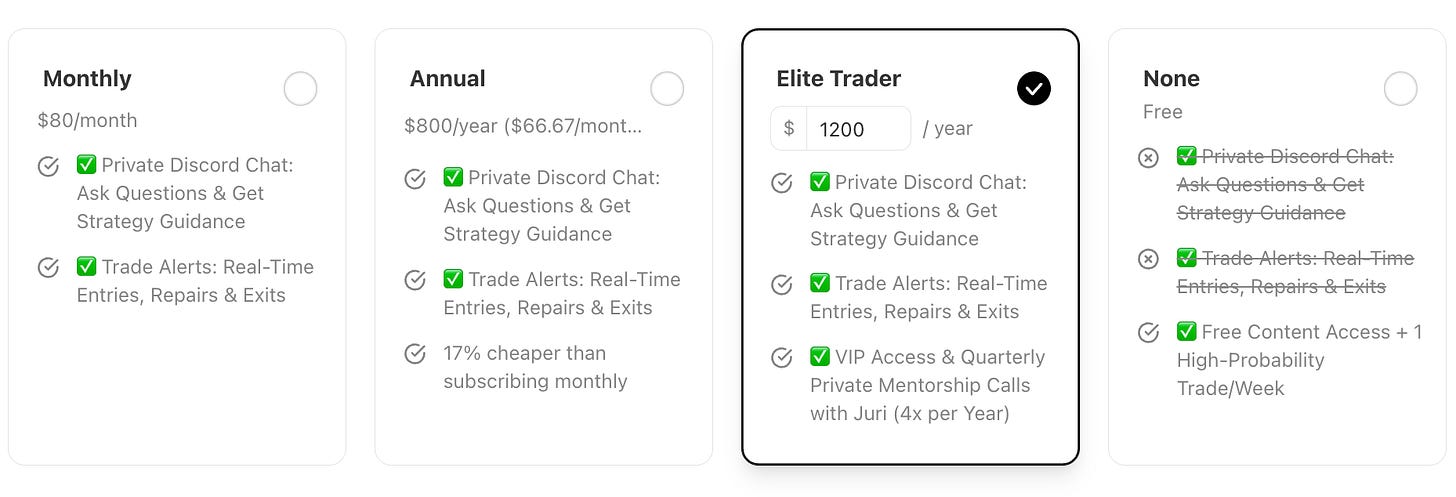

📌 Choose Your Access

👉 Free Access — $0/month

✅ Weekly high-probability trade idea

✅ Educational content

❌ No alerts or chat access

👉 MacroDozer Pro — $80/month or $800/year

✅ Real-Time Trade Alerts

✅ Private Discord Chat with Juri

❌ No VIP Access

👉 Elite Trader — $1200/year

✅ Everything in Pro

✅ 1:1 Zoom Calls (4/year)

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.