Wall Street cheered the US-EU deal like it was a tariff pause. But let’s call it what it really is: a cash funnel from Europe into the U.S. — without needing the Fed to print a dollar.

Here’s the trade: Europe takes a 15% tariff hit on nearly everything it exports, agrees to buy $750B worth of U.S. energy, and promises $600B in new U.S. investments. In return? A confused, overpromoted Ursula smiling for the camera. But this isn’t peace; it’s power disguised as partnership. Europe gets inflation and weaker exports. America gets demand, capital inflow, and political bragging rights.

If this sounds like monetary easing without using central banks, you’re getting warm. Call it America’s hidden liquidity pump — Europe buys U.S. assets and fuels American growth while its own margins shrink. The euro tanked on the news, and it won’t be the last price to drop.

And while Powell stays in his neutral corner, Trump just engineered the next wave of American stimulus — funded by Berlin, Paris, and Madrid.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

Dollar Reversal Risk

H1 delivered the weakest dollar since 1973, yet a single tariff win drove the euro’s sharpest one‑day slide in two months. With term‑premium rising and real short‑rates dipping, a positioning squeeze could flip the consensus from short‑USD to king‑buck in days, not quarters.

Mag‑7 Earnings Roulette

Microsoft, Meta, Amazon, and Apple drop numbers this week with option markets pricing the smallest post‑earnings moves in three years. Last week’s semiconductor prints shattered similar low‑volatility assumptions (‑13 % in TXN). Right tail and left tail are both under‑priced — cheap straddles on core holdings look attractive for once.

Debt vs. Growth: The Yield Crossover

For the first time in two decades, 10‑year Treasury yields are converging with nominal GDP. That ends an era of effortless debt service and makes every deficit dollar costlier. If yields break above growth, expect accelerated talk of yield‑curve control—or tougher spending choices Washington has avoided for years.

China Equities: Under‑Owned Outlier

MSCI China is up 25 % YTD — second‑best since 2010 — yet hedge‑fund and mutual‑fund exposure remains below median. Southbound flows from mainland investors hit four‑year highs, hinting at domestic conviction. If the dollar does rebound, Asia might offer the cleanest earnings growth‑plus‑FX hedge.

Volatility Products: Insurance or Ignition?

Zero‑day S&P options now exceed 60 % of total index‑option volume, matching peak retail speculation periods. These contracts suppress realized volatility — until a one‑way flow forces dealers to hedge in size, converting dampeners into accelerants. Treat VIX under 14 as borrowed time.

Get Rich Overnight with Options? Yeah Right...

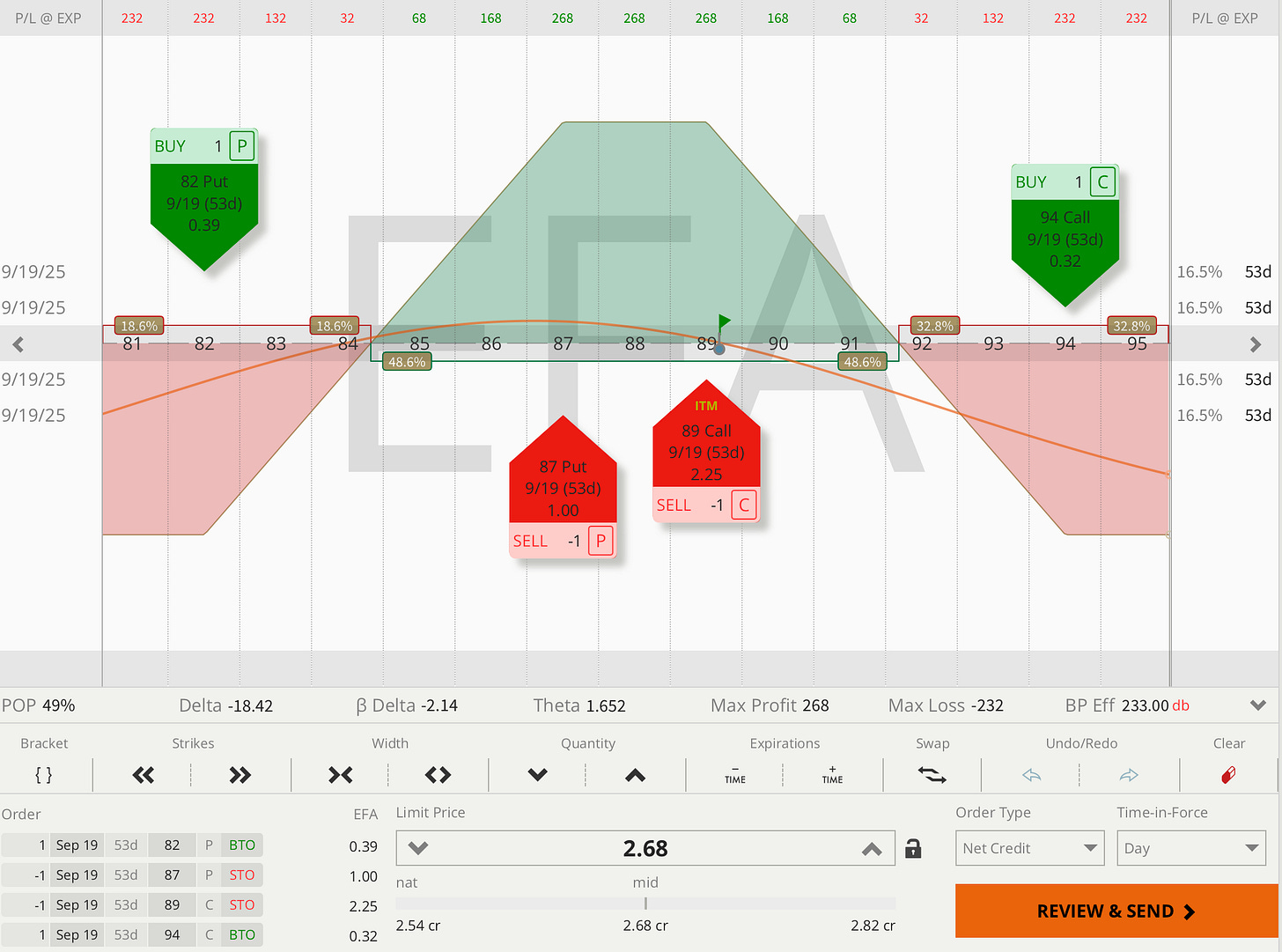

TUESDAY TARGET: Bearish into strength — don’t try this alone. But we like the setup. Energy prices are firm, the euro’s cracked, and Europe just agreed to bankroll America’s next leg higher. SAP, HSBC, Sony… good luck shifting that gravity.

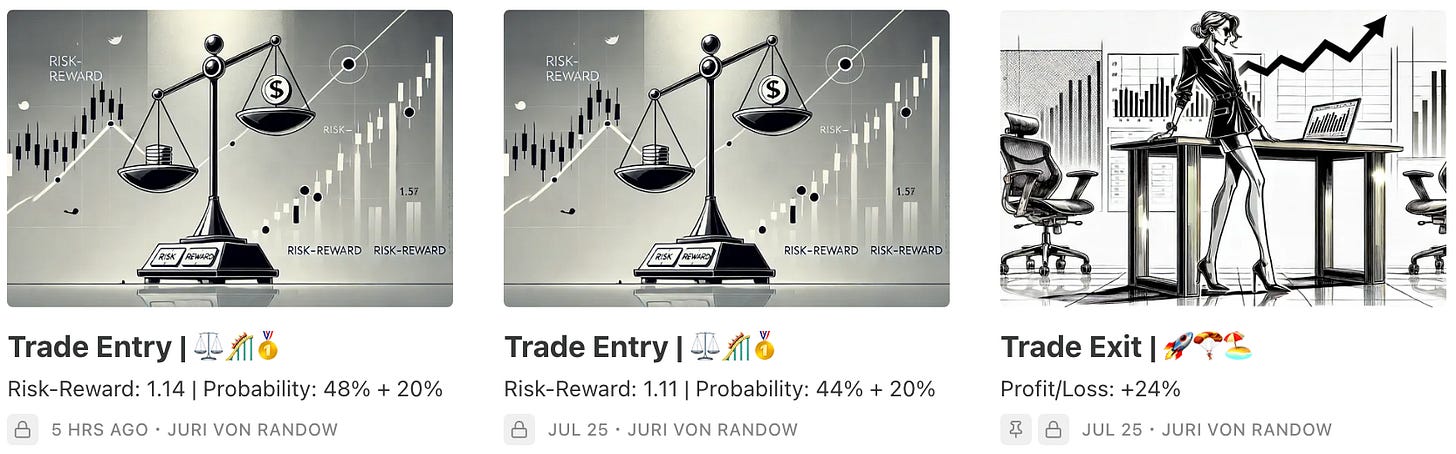

Want these trade ideas instantly? Check out the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

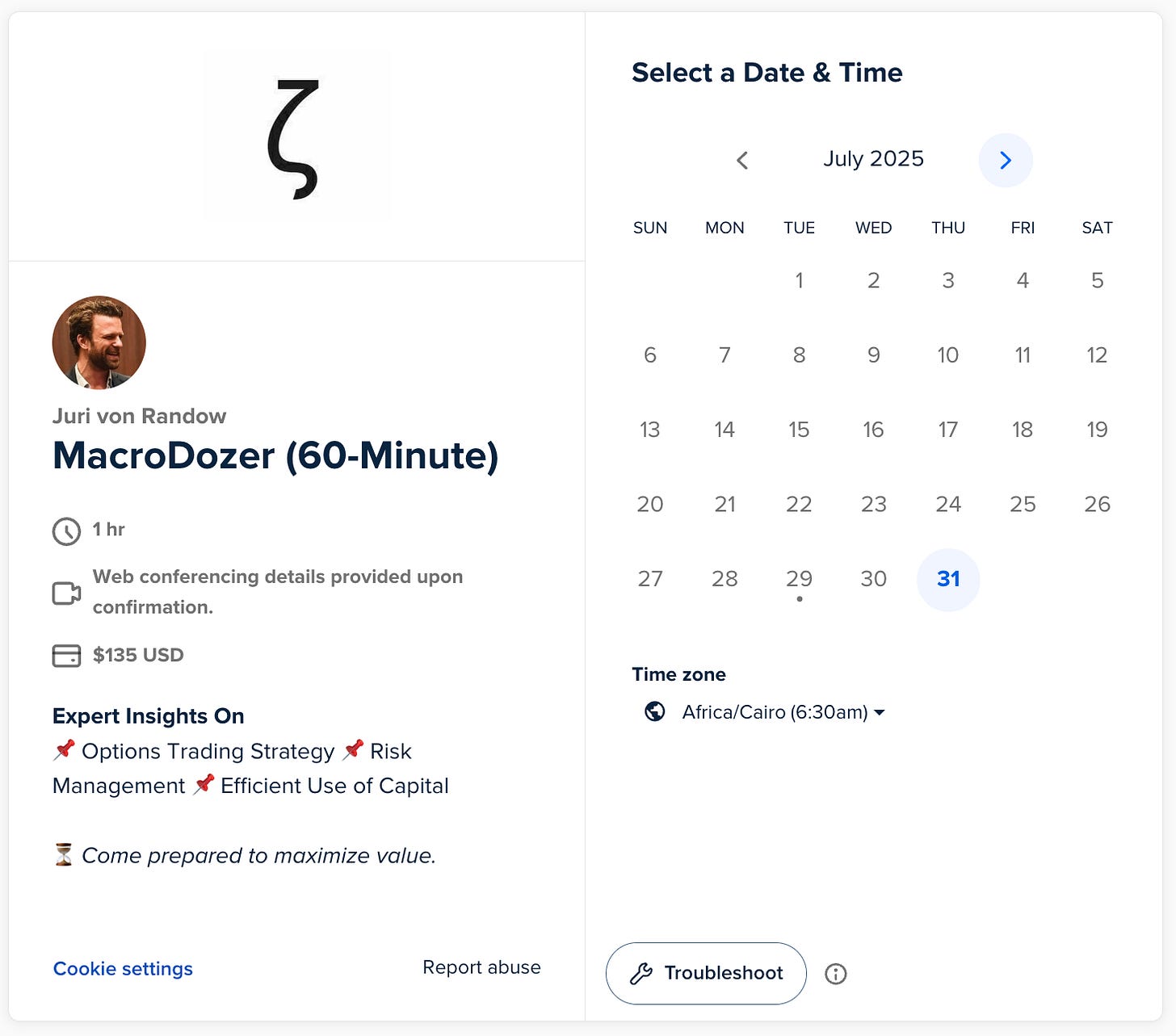

📌 1:1 Mentorship Call

Book a 60-minute Zoom session to master your strategy fast.

Ask anything — options, capital, risk

Tailored feedback on your trades

Built for serious traders ready to accelerate

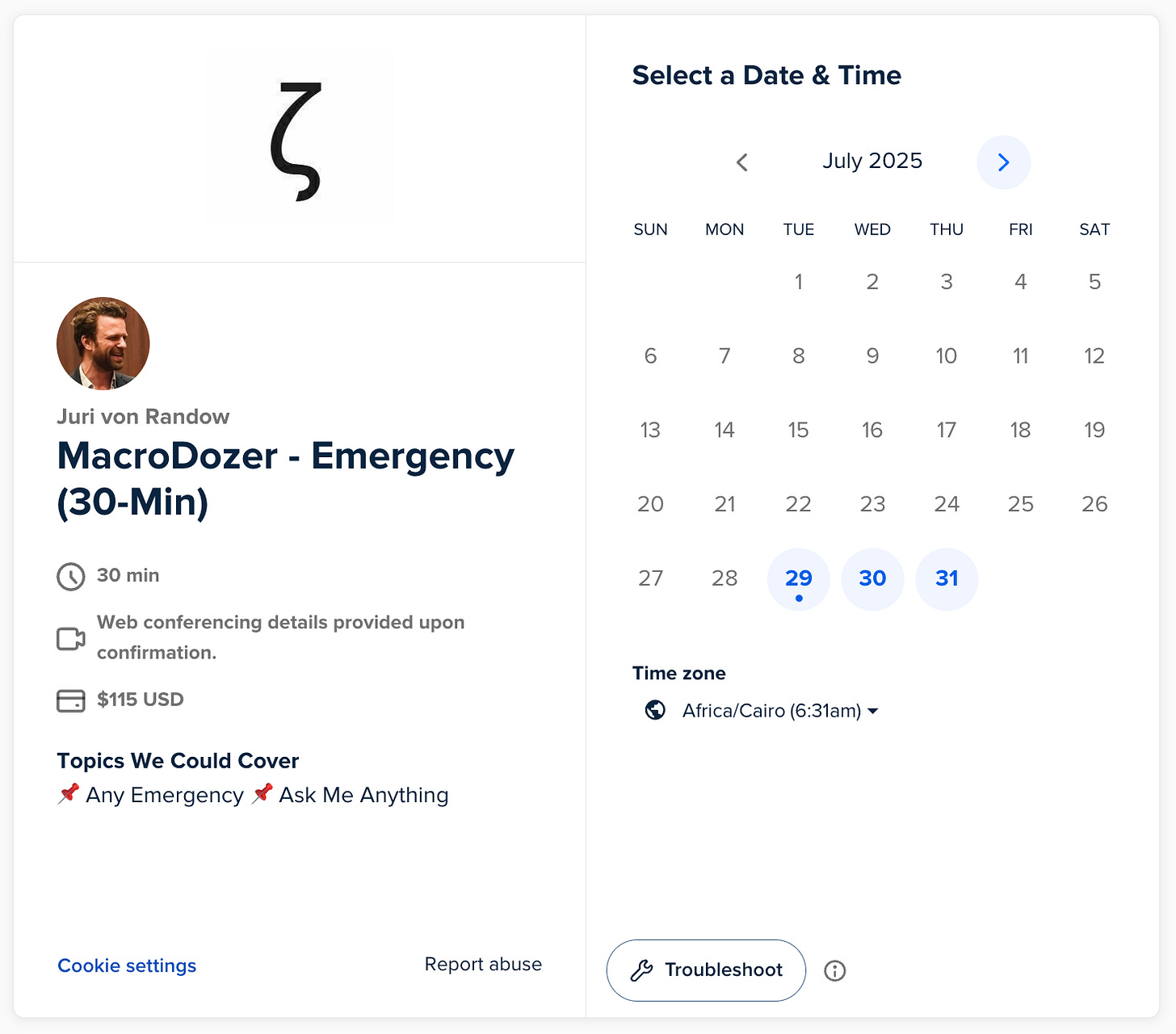

📌 Emergency Call

For urgent trade issues, market stress, or timing-critical decisions.

Market crash? Last-minute setup?

Get clear, educational guidance — no fluff

Available pre-close, late nights, and early mornings

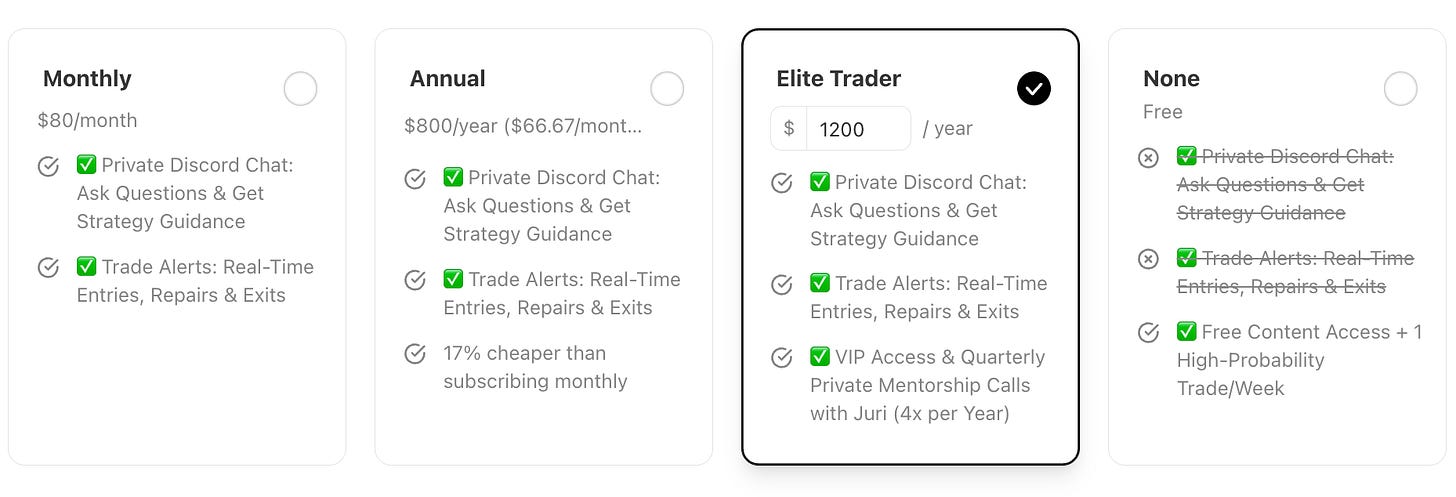

📌 Choose Your Access

👉 Free Access — $0/month

✅ Weekly high-probability trade idea

✅ Educational content

❌ No alerts or chat access

👉 MacroDozer Pro — $80/month or $800/year

✅ Real-Time Trade Alerts

✅ Private Discord Chat with Juri

❌ No VIP Access

👉 Elite Trader — $1200/year

✅ Everything in Pro

✅ 1:1 Zoom Calls (4/year)

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.