Wall Street is humming lullabies while tip-toeing over trip wires. Markets glide at record highs, trend-following algorithms blindly chase momentum, and zero-day option cowboys bet as if liquidity were infinite. Yet three loaded chambers spin toward next week:

Tariff Snap-Back: On August 1, duties of 30–50% slam into EU, Canadian, and Brazilian imports unless Washington stages another “11th-hour miracle.” Front-loaded inventories only delay the bruise — they don’t cancel the punch.

Powell Roulette: Each presidential hint at firing the Fed chair erodes dollar credibility. Removing Powell mid-match would spike short-term yields, shake long bonds, and crater trust beneath risk assets priced in U.S. fiat.

Free-Fire Insurance: Tech giants now equal their dot-com-era weight in the S&P, yet their earnings-day volatility is priced at 20-year lows. Three-month tech ETF (XLK) puts trade cheaper than pizza, as relentless call-selling ETFs hold volatility (VIX) down — a perfect setup for a volatility jailbreak.

Maybe all three chambers misfire — markets adore fairy tales — but odds worsen as summer liquidity thins. One tariff headline, weak job report, or pink slip at Fed headquarters could flip systematic buyers into forced sellers faster than retail gamblers can reload Robinhood.

Before chasing the next AI nirvana or meme-coin revival, decide if you're betting on lullabies or strapping on body armor. Because when the chamber stops spinning, only portfolios carrying real protection — and an exit map — will walk away with more than confetti.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

Retail Leverage: 0‑DTE Fever

Zero‑days‑to‑expiration options now represent the majority of retail derivatives flow, dwarfing ordinary stock commissions at brokers such as Robinhood. History rhymes: when the least‑experienced investors seek lottery‑ticket pay‑outs via leverage, drawdowns rarely take long to follow.

Robots versus Humans: Systematic Bid Masks Outflows

Trend‑following and volatility‑control programs have injected roughly $100 billion of mechanical demand into global equities over the past month, obscuring the fact that hedge‑fund net selling hit a three‑month high. Should the S&P slip below trend (≈ 6100), those same models flip to net sellers.

Long Bonds Signalling: When Yield Ends the Party

Thirty‑year Treasuries are flirting with 5 % while rate volatility (MOVE) remains subdued. Credit‑sensitive assets have historically ignored similar yield climbs—right up until liquidity drains force repricing.

AI Build‑Out: Debt Mountain Behind the Hype

Morgan Stanley tallies nearly $3 trillion in datacentre investment through 2028, leaving a $1.5 trillion funding gap even after hyperscaler cash flow. Translated: the AI gold rush is about to rely heavily on public and private credit markets, pressuring spreads and levering balance sheets just as the cycle matures.

Brussels’ Counterpunch: Europe Gears Up

EU officials signal they will match U.S. tariffs “in full” if talks fail—Germany now echoing France’s hard line. European equities already show weaker profit surprises this season; retaliatory duties would add earnings pressure just as the euro strengthens.

Crypto’s $4 Trillion Moment: Bubble or Base Layer?

Digital‑asset market cap crossed $4 trillion on an alt‑coin surge, while Ethereum‑treasury companies copy MicroStrategy’s playbook. Bitcoin dominance keeps slipping, yet leverage and retail FOMO echo late‑2021 dynamics. Long‑term investors should separate base‑layer adoption from speculative froth.

Get Rich Overnight with Options? Yeah Right...

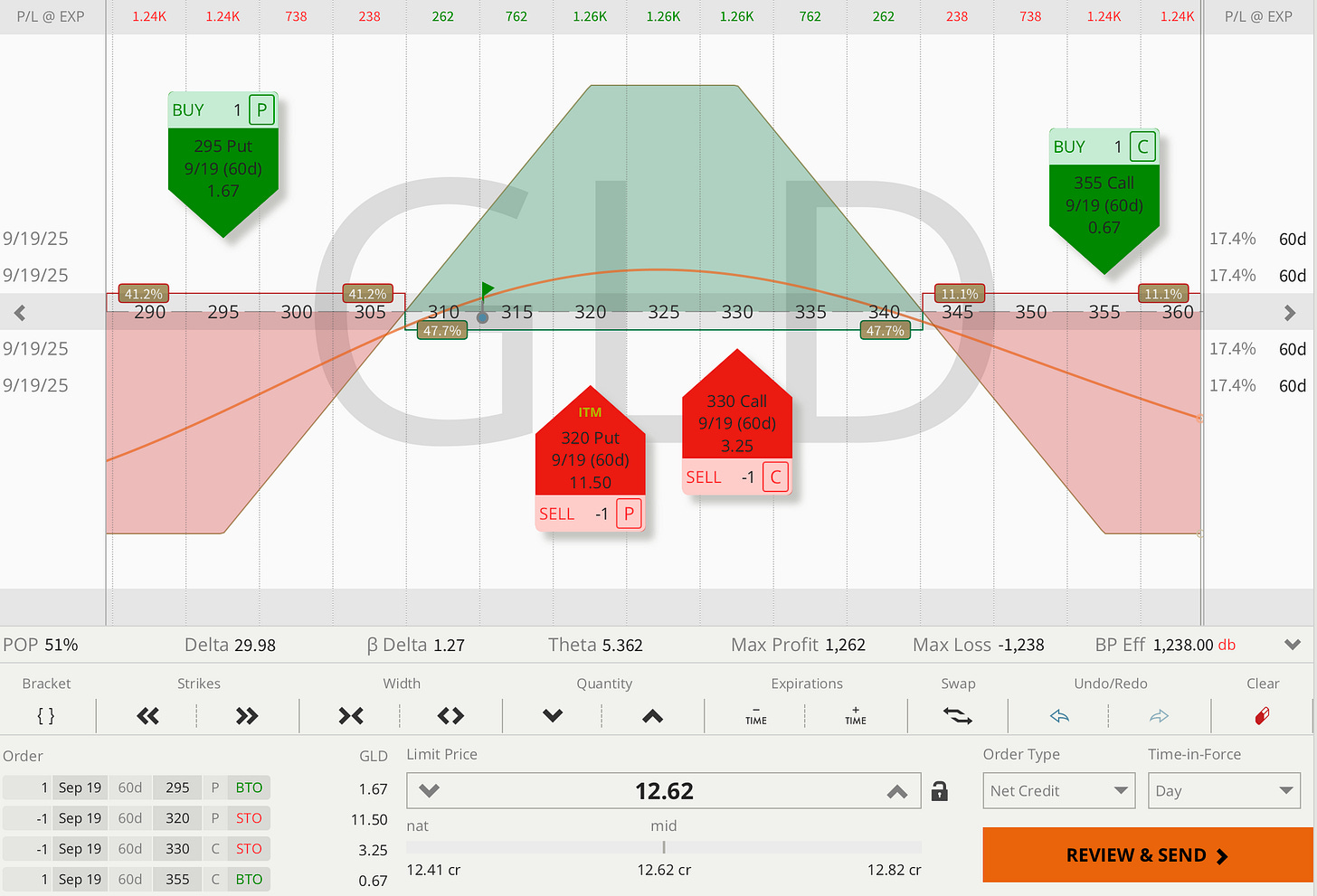

TUESDAY TARGET: When you think gold is consolidating, but it’s actually going up… Now our portfolio is short-term bearish silver vs. short-term bullish gold — not the worst place to be over the next 1.5 months.

Want these trade ideas instantly? Check out the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

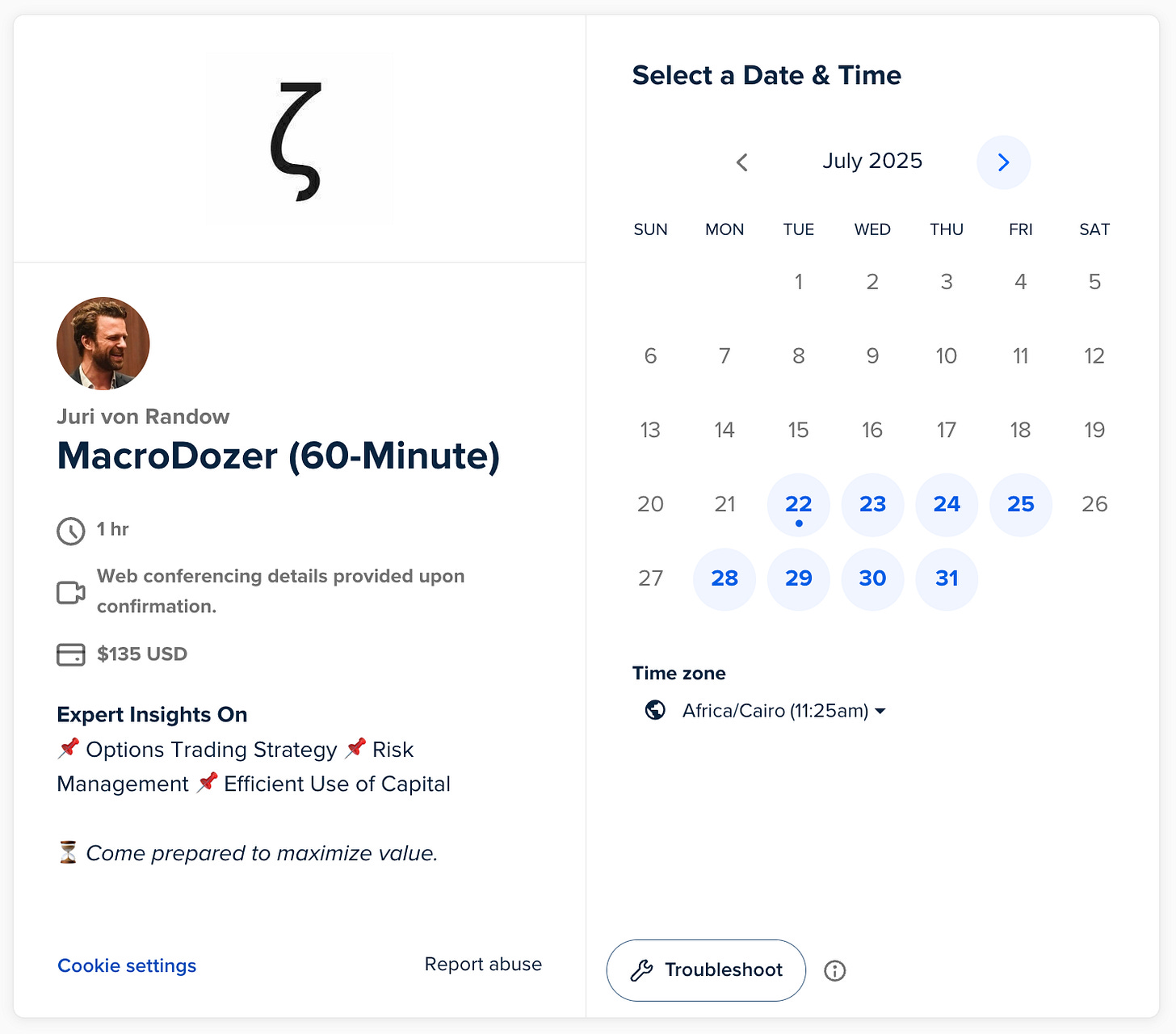

Curious about integrating these insights into your own portfolio — or just bouncing ideas? Book a 60-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.