Imagine the cockpit lights start flashing, the pilot’s headset crackles, and a steward strolls down the aisle asking passengers if anyone feels qualified to land the plane. That’s basically where we are with monetary policy. Treasury Secretary Scott Bessent just kicked off a public talent show to replace Jerome Powell while the current Chair is still strapped in at 30,000 feet. Markets did not veto. Why worry about institutional credibility when you can front-run rate-cut rumors on X?

But here’s the other angle: the real risk isn’t the name of the next pilot — it’s the growing line of creditors who suddenly want to sit closer to the exit. If markets believe the next boss is there to print money, cap yields, or juice Trump’s polls, they’ll price that in before anyone’s confirmed. That’s when long-term bondholders start demanding extra yield, and suddenly the most risk-free asset in the world becomes the sketchiest seat in the house.

Meanwhile, sovereign bond liquidity is quietly vanishing. Japan’s long-end yields are blowing out, the UK and France are seeing foreign holders step back, and in the U.S., Treasury buybacks are already being whispered like some shadow QE reboot. Even Jamie Dimon feels the tremor: he just wedged $50 billion into private credit while warning that exactly that might blow up the system. Translation: the fire marshal is buying kerosene because the crowd looks thirsty.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

Washington’s Chip Flip

Three months after banning AI chips to China, the White House green‑lights Nvidia’s watered‑down H20 exports. Markets cheer, but the message is louder: technology sanctions are now a barter chip for rare‑earth access.

Summer Liquidity Void

Buyback blackout runs through early August, CTAs sit near max‑long equities, and retail sentiment just posted its biggest three‑month surge on record. One sharp data miss or geopolitical tweet can snowball into a 4–5 % tape flush.

Earnings Beat ≠ Balance‑Sheet Health

JPMorgan’s headline EPS crushed estimates, but look under the hood: net‑interest income missed, credit‑card charge‑offs keep climbing, and a $774 million tax benefit juiced the bottom line. Banks are paying you prettier dividends while quietly reserving for consumer stress.

Retail Euphoria Tops 2001

BofA’s risk‑appetite gauge just logged its largest three‑month jump ever. Retail option volume is back to meme‑era highs, and zero‑day call spreads dominate flow. Historically, peaks in that sentiment metric precede an S&P retrace within a month.

Get Rich Overnight with Options? Yeah Right...

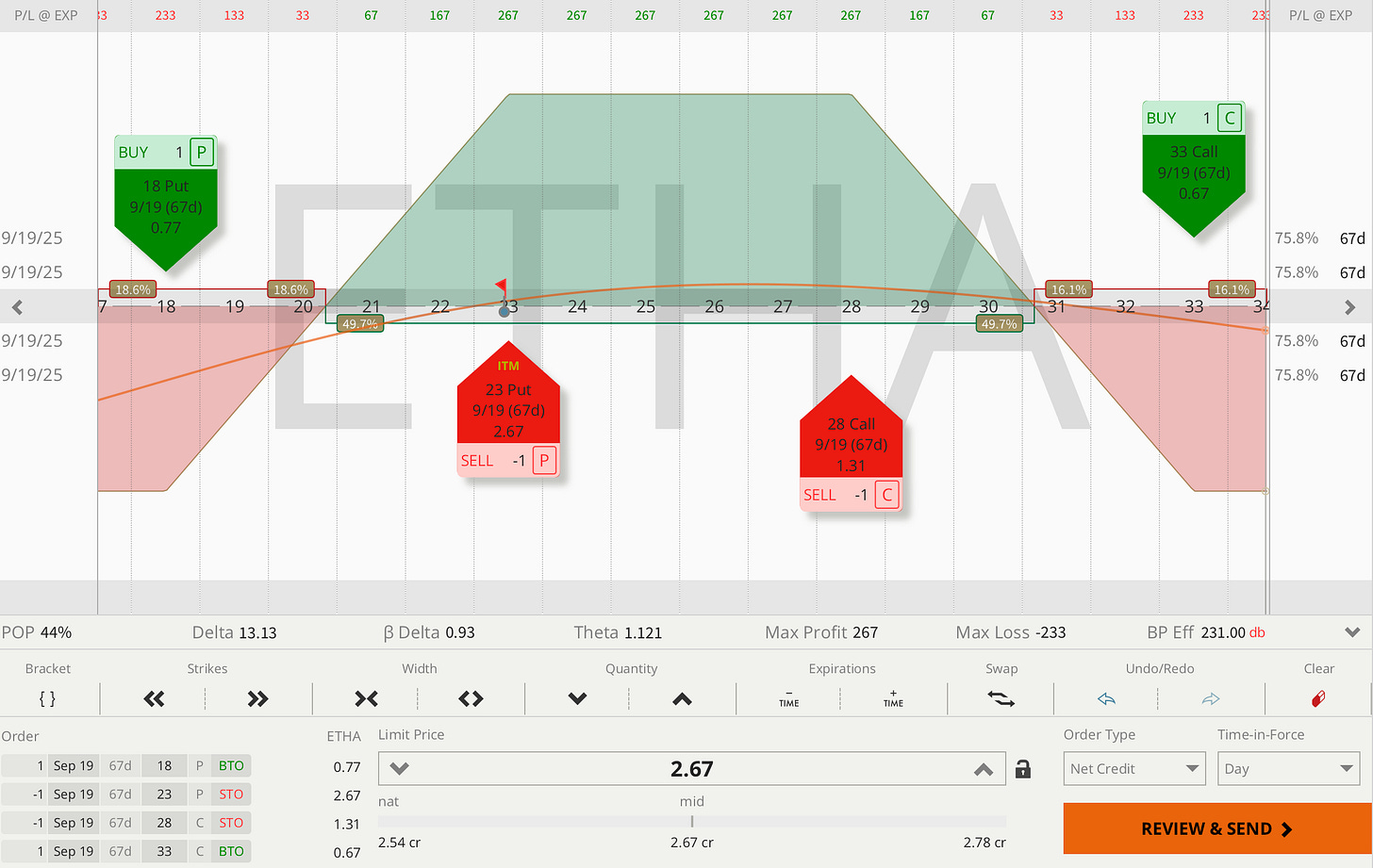

TUESDAY TARGET: Last week, we wrapped a bullish condor around the wildest asset BlackRock ever embraced — Bitcoin. Just being at the top of that crypto air-money madness is impressive. Now we’ve entered a similar bullish condor on Ethereum — the second-most unhinged asset BlackRock somehow turned into a surprisingly well-functioning ETF. There’s room to run, and even a dip to the lower mid-range would mean just a 25% paper loss — manageable with a roll.

We usually avoid doubling up on assets in the same sector, but since we’re diversifying by timing, this move actually improves portfolio balance.

The bid-ask spread isn’t tight, but the risk-reward is strong. Don’t sweat saving pennies on the entry — we’re targeting a 50–70% return on risk capital. A 1.5% slippage? Not worth the headache — your Amex charges more.

Want these trade ideas instantly? Check out the Trade Alerts section.

As mentioned above, all our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

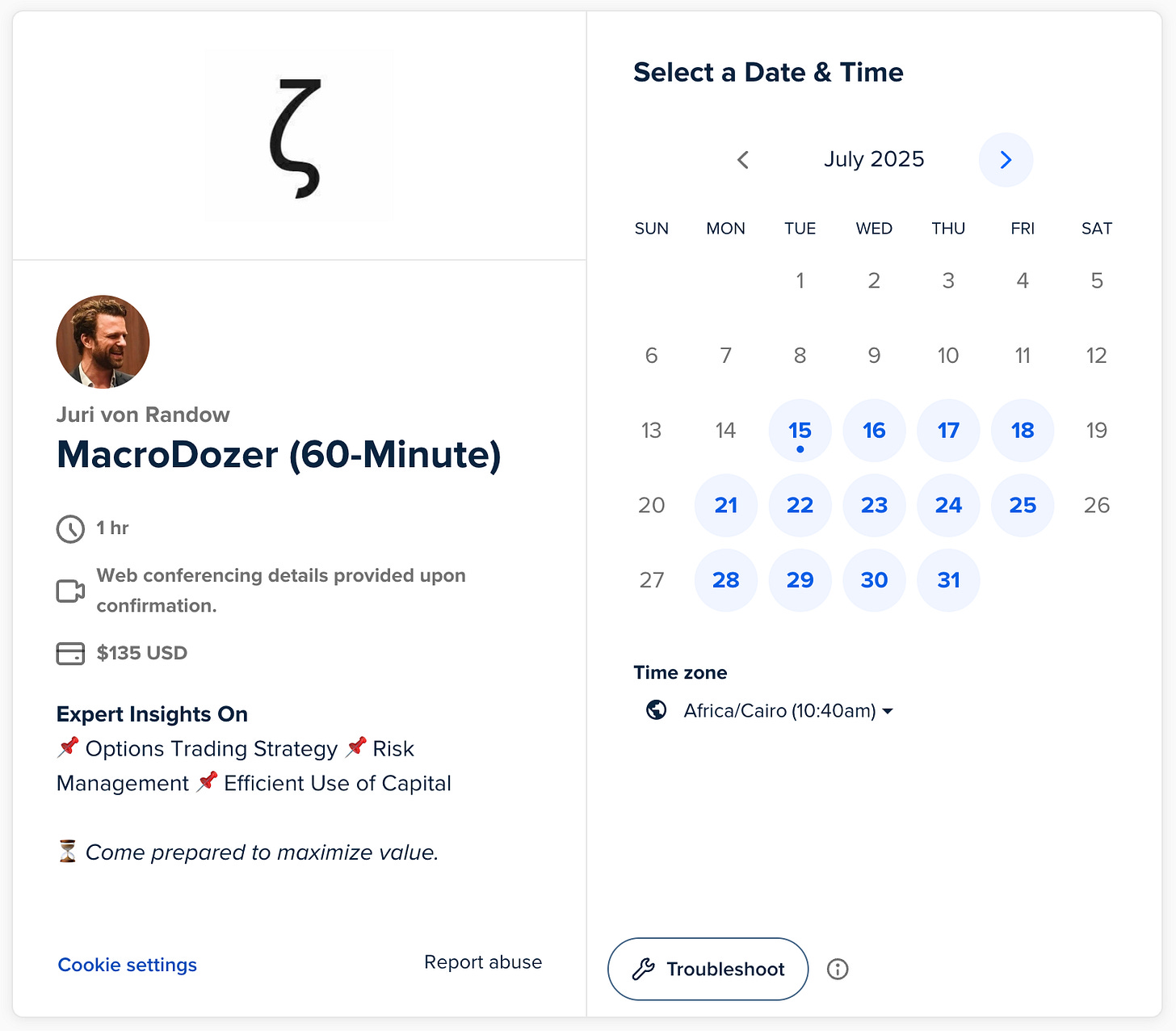

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a 60-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.