Picture the funeral of the U.S. dollar. Mourning investors draped in euro‑silk, yen kimonos, and digital‑gold capes share war stories about the end of American exceptionalism. Hedge‑fund obituaries cite record‑short positions; Wall Street strategists hum Kumbaya over a DXY that hasn’t traded this far below its 200‑day in two decades. Even grandma’s pension fund is dumping greenbacks to hedge her Tesla ETF. The only problem? The alleged corpse is still breathing — and the room smells more like crowded-trade sweat than formaldehyde.

When every macro podcast, flow tracker, and cocktail‑party guru agrees the dollar can only spiral lower, contrarians know a different script is loading. CTAs are $95 billion from max‑long equities, but they’re running their largest dollar shorts since 2004. Retail has gone full meme, parking 50 % of volume in pennystocks while ignoring FX risk like it’s a landline. Meanwhile, Treasury supply is about to rocket as the $5-Trillion-Beauty-Bill hits the tape — dollar liquidity is set to shrink just as positioning screams short‑squeeze tinderbox.

Remember when Liberation Day tariff headlines nuked risk for 48 hours — until the White House hit the mute button? Rising yields and a dollar pop hurt everyone at the table. Fast‑forward to today: options markets price ±1 % for tomorrow’s tariff deadline, the VIX naps in the teens, and bond vol prints fresh lows. Translation: dealers are short upside gamma on the buck and will be forced to buy if DXY twitches north of 98. Add a surprise CPI blip or a hedge fund de-grossing, and the dollar funeral could flip into a Tarantino-style resurrection.

So before you RSVP to the dollar’s wake, check the exits. The doorframe is narrow, the room is over‑capacity, and the guest of honor just coughed.

Below, as always, the minimum you need to stay ahead:

Short‑Squeeze Karma: Momentum Rolls

Goldman’s most‑short basket fell 2 % this week and high‑beta momentum pairs unwound 6 %, a top‑10 drawdown in five years. Factor fragility suggests the reflexive squeeze phase is fading; funds that chased late are vulnerable to an air pocket into earnings season.

OPEC+ Flood Risk

Saudi‑led producers add 548 kb/d next month, the fourth straight upside surprise. Summer demand keeps Brent near $70, yet inventories already build at 1 mb/d. If shale output stabilises and product cracks soften, crude could test $60 by Q4, reversing the inflation‑sensitive energy trade.

China’s Data‑Sector Purge

High‑profile arrests in Guizhou’s “big‑data valley” expose graft inside Beijing’s AI strategy. Beyond governance optics, sudden leadership voids can stall data‑marketplace rollouts and delay cloud capex — bearish for Chinese hyperscale demand and global semiconductor sales premised on a seamless AI boom.

BRICS Tariff Surcharge: Weaponised Reserve Status

The White House floats an extra 10 % levy on nations “aligning” with BRICS de‑dollarisation. Far from protecting U.S. standings, such blanket penalties may accelerate parallel payment rails, nudging marginal trade settlements toward CNY or rupee and diluting the very seigniorage Washington seeks to defend.

Get Rich Overnight with Options? Yeah Right...

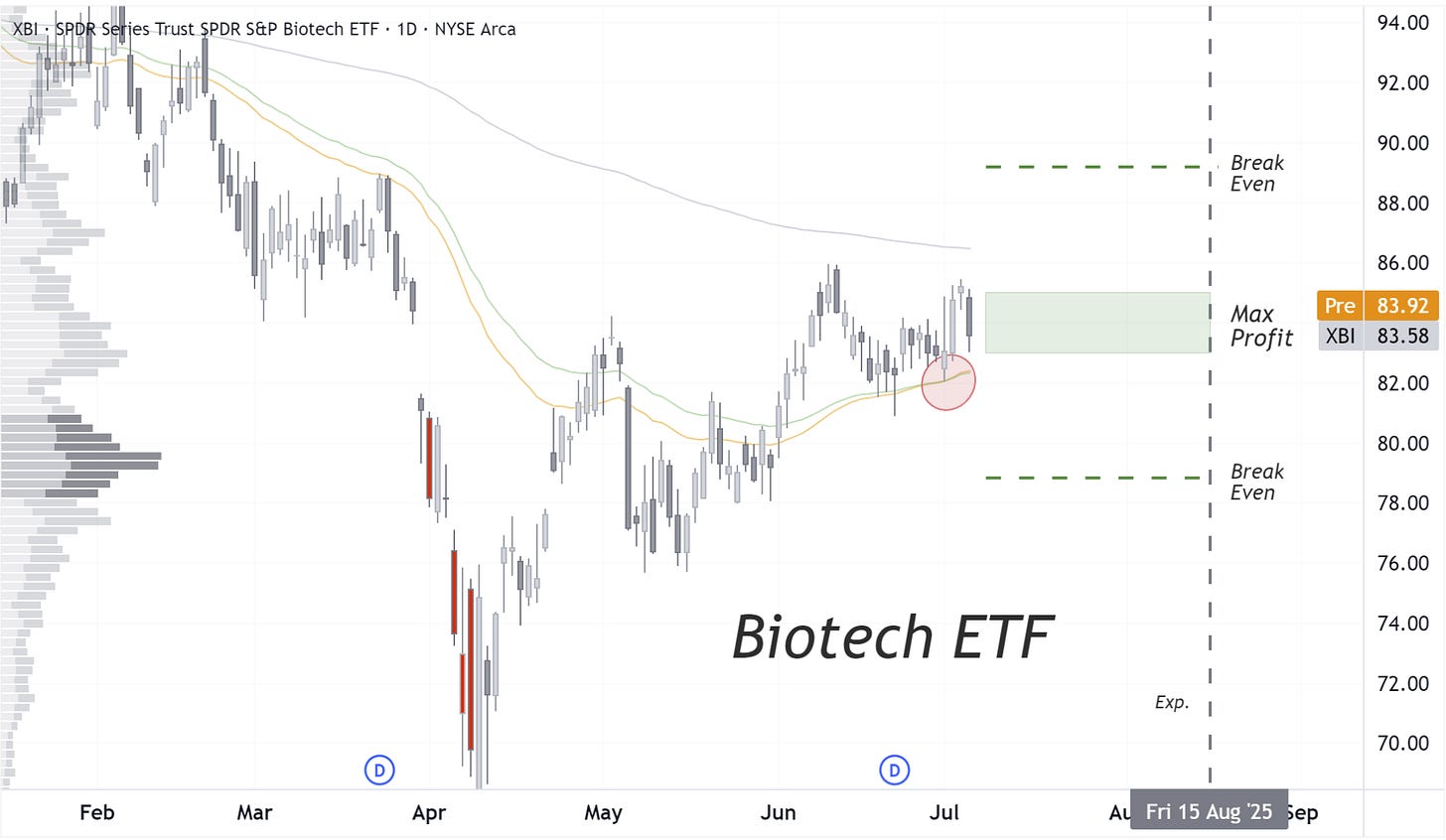

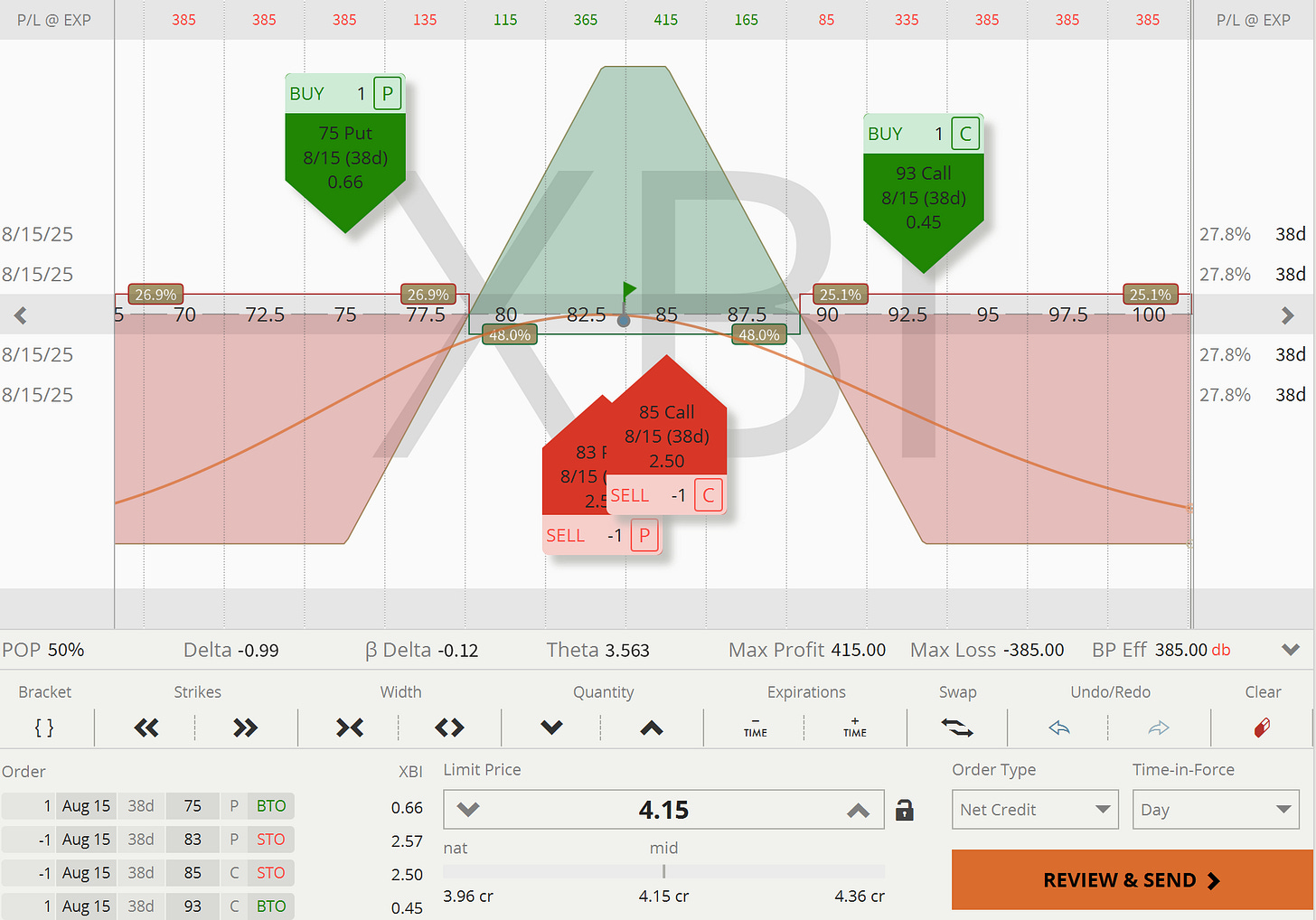

TUESDAY TARGET: We haven’t entered a new trade yet this week. XBI Biotech is on our shortlist, but if we do decide to go for it, keep an eye out for the official trade alert. We've already got a solid number of trades on for this options cycle, so no need to force it.

Want to get those trade ideas instantly? Check out the Trade Alerts section.

As mentioned above, all our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

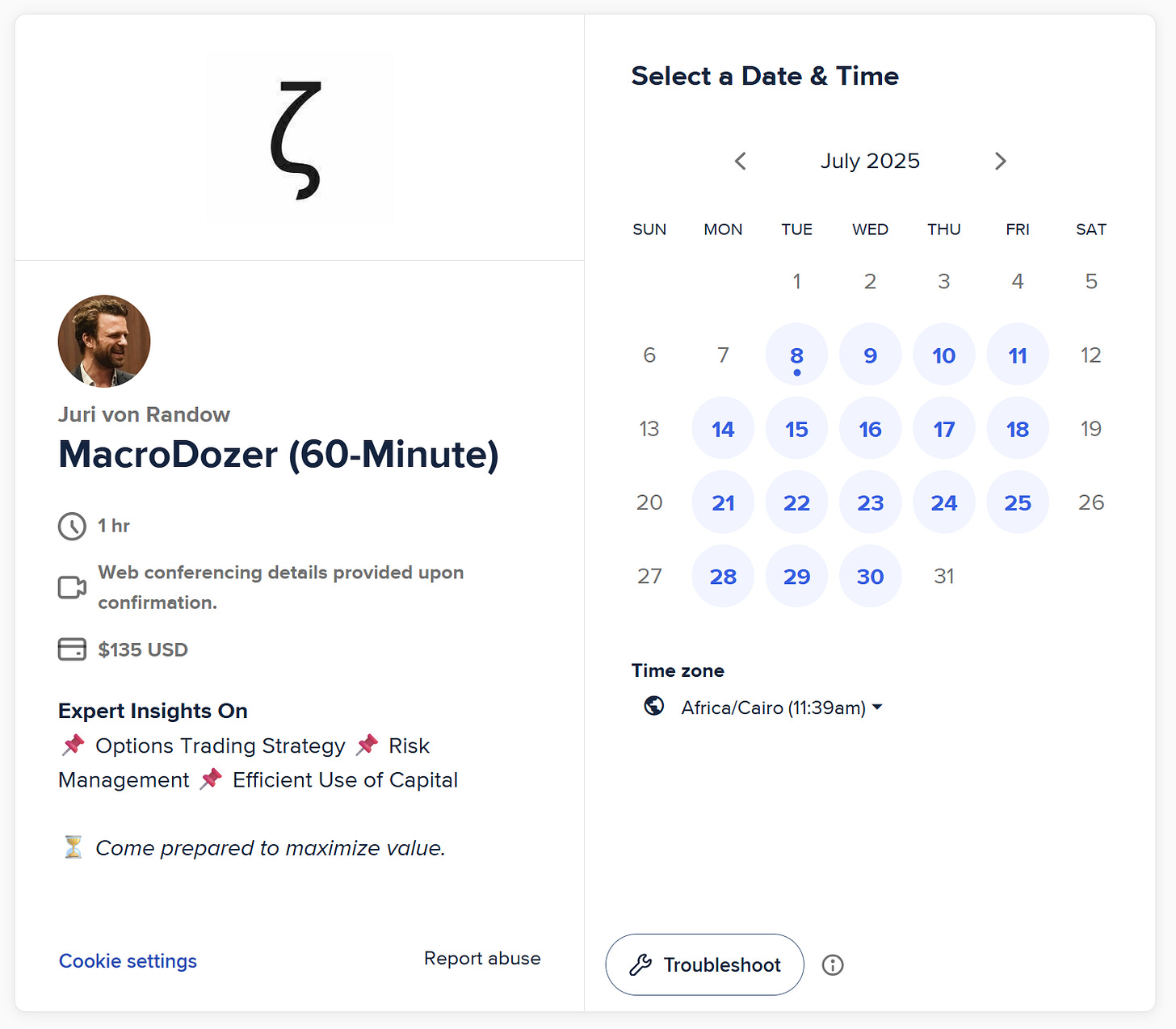

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a 60-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.