If you thought Independence Day was loud, wait until Congress lights $3 trillion of deficit dynamite and calls it tax reform. The “Big Beautiful Bill” is being sold like sparklers for the middle class — cap gains cuts, child-credit confetti, infrastructure glitter. House leaders swear the show pays for itself “over time,” the same way teenagers promise the garage won’t burn down. Markets, dazzled by stimulus headlines, keep buying the popcorn.

Meanwhile, the bond market is reaching for the fire extinguisher. Two decades of cheap Fed backstops taught investors to ignore fiscal math — until last week’s 30-year auction reminded everyone that duration still bites. Primary dealers absorbed the leftovers, yields popped, and the term premium — the price of trusting Washington — hit a two-year high. Translation: Powell’s not calling the shots anymore. When your credit card company starts budgeting for you, the party’s already over-leveraged.

Here’s what I think: if the bill squeaks through, we get a sugar rush — maybe one last melt-up into July’s seasonal sweet spot. But if it stalls (or if long yields spike again), we’ll still get fireworks — just the kind that torch momentum trades, regional banks’ bond portfolios, and any illusion that two rate cuts will fix what’s broken. Either way, the tab lands on portfolios that mistake debt-funded growth for a free lunch.

Below, as always, the minimum you need to stay ahead:

Tariff Reality Check

Tokyo just admitted what the May trade data already showed: Japanese automakers, not U.S. consumers, have been eating the 24 % car levy. Now Trump inks a Vietnam deal with a 20 % blanket tariff plus a 40 % trans‑shipping penalty aimed at China. Conclusion? Supply‑chain profit margins will cushion CPI longer than most macro models assume—but exporters’ EPS risk is just starting.

Record Highs, Record Narrow

Just 22 S&P companies tagged fresh highs during last week’s breakout, versus 54 in August 2020. Mag‑7 now control 38 % of index cap and 30 % of earnings. Breadth this poor has historically capped further upside to single digits before a minimum 5–7 % shakeout.

Dollar’s 1973 Impression

The trade‑weighted greenback has slid 10 % in six months — its worst first‑half performance since Bretton Woods cracked. Rate differentials can’t explain it; capital flows can. Foreign buyers have quietly stepped away from Treasury auctions, leaving U.S. households and money‑market funds to plug the gap. A structurally weaker USD lifts overseas revenues but also imports foreign inflation right when tariffs are layering on top.

Luxury: Three‑Sigma Sale

European luxury sits nearly three standard deviations oversold; prior instances saw 76 % outperformance over the next quarter. U.S. high‑income demand is still solid, and FX tailwinds emerge if the euro stays bid. LVMH calls dated November look attractive: low implied vol and a fundamental mean‑reversion catalyst.

Get Rich Overnight with Options? Yeah Right...

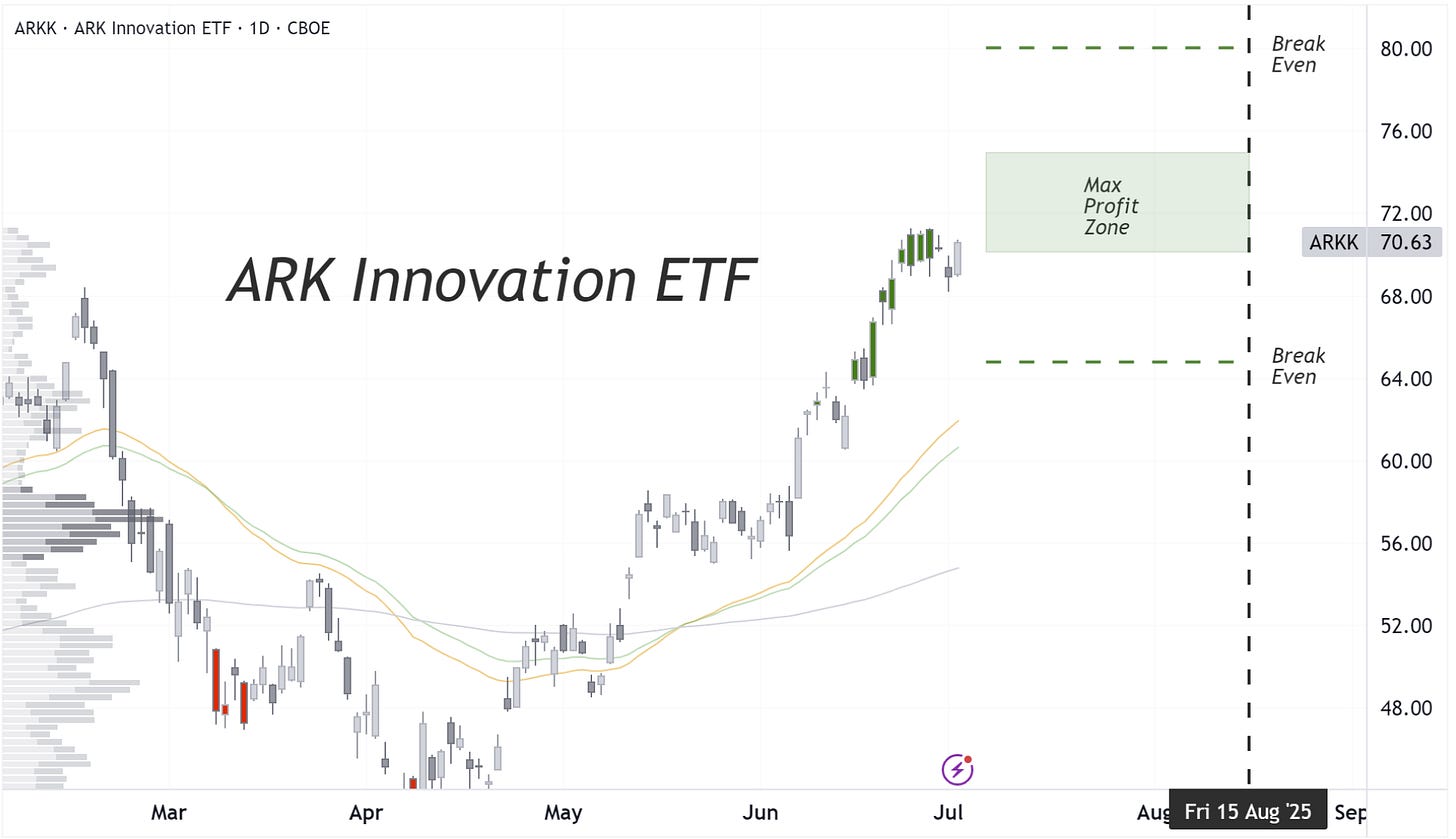

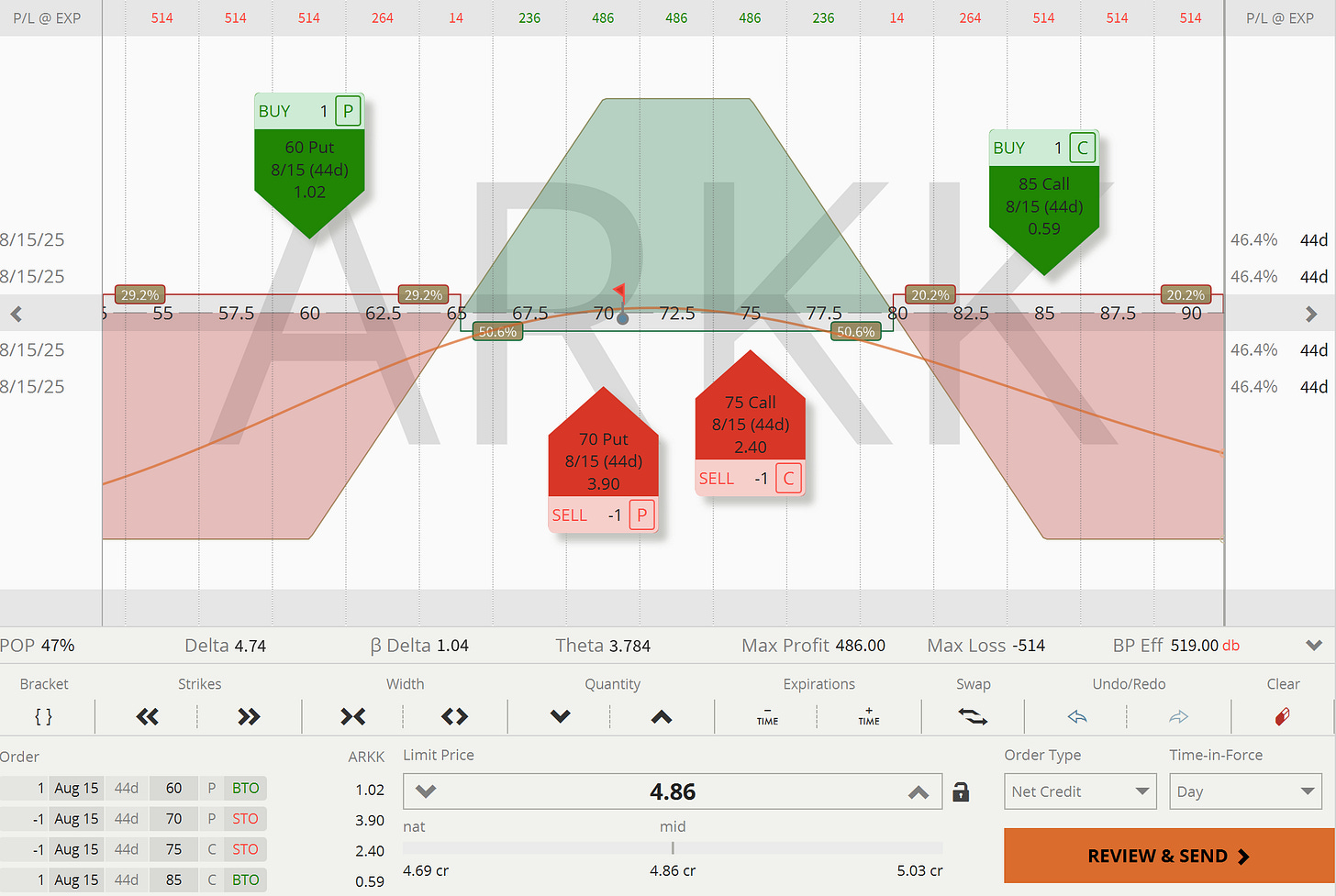

TUESDAY TARGET: Living the dream, pushing the limits, buying the dip? We’ve always wanted to do all of that, so we’re pumped to give it a go.

Enter Crazy Cathy, on a mission to claw back the billions in pension money lost during her great wipeout of 2021 and 2022. Thousands of investors watched their savings evaporate — yet somehow, through the magic of bold headlines and louder interviews, she managed to frame an 80% fund collapse as a masterstroke of innovation.

People bought it. They still do. A war hero, they say. And that, my friends, she is. That she truly is.

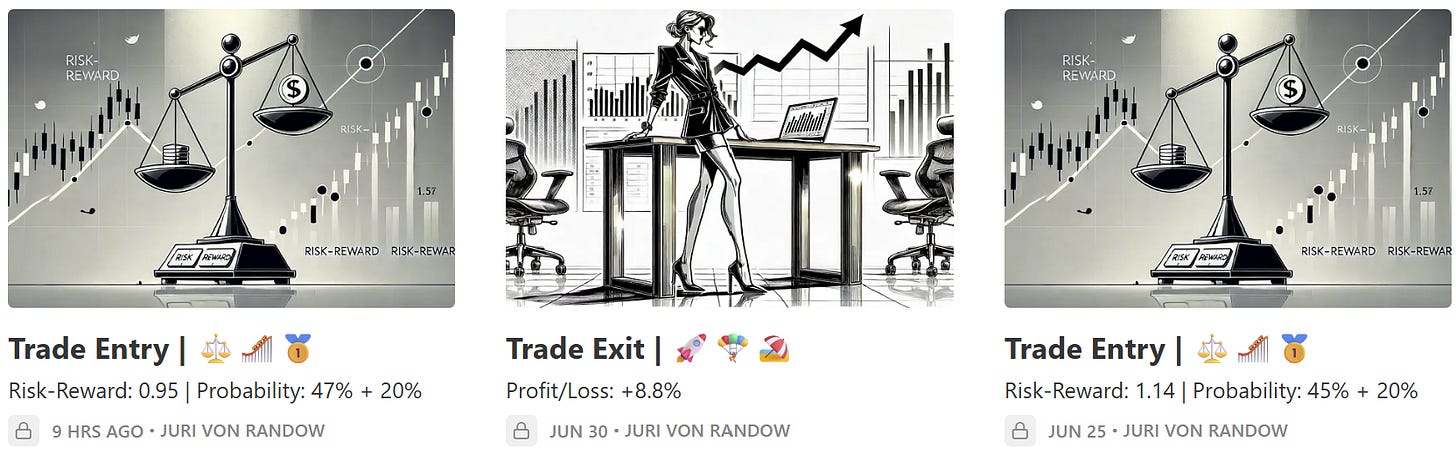

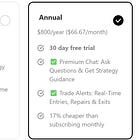

Want to get those trade ideas instantly? Check out the Trade Alerts section.

As mentioned above, all our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a 60-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.