TG THERAPEUTICS: MacDoζe Winter-Blows 3/4 (+127%)

Drug Testing and Volatility Implosions Go Back a Long Way.

Executive Summary

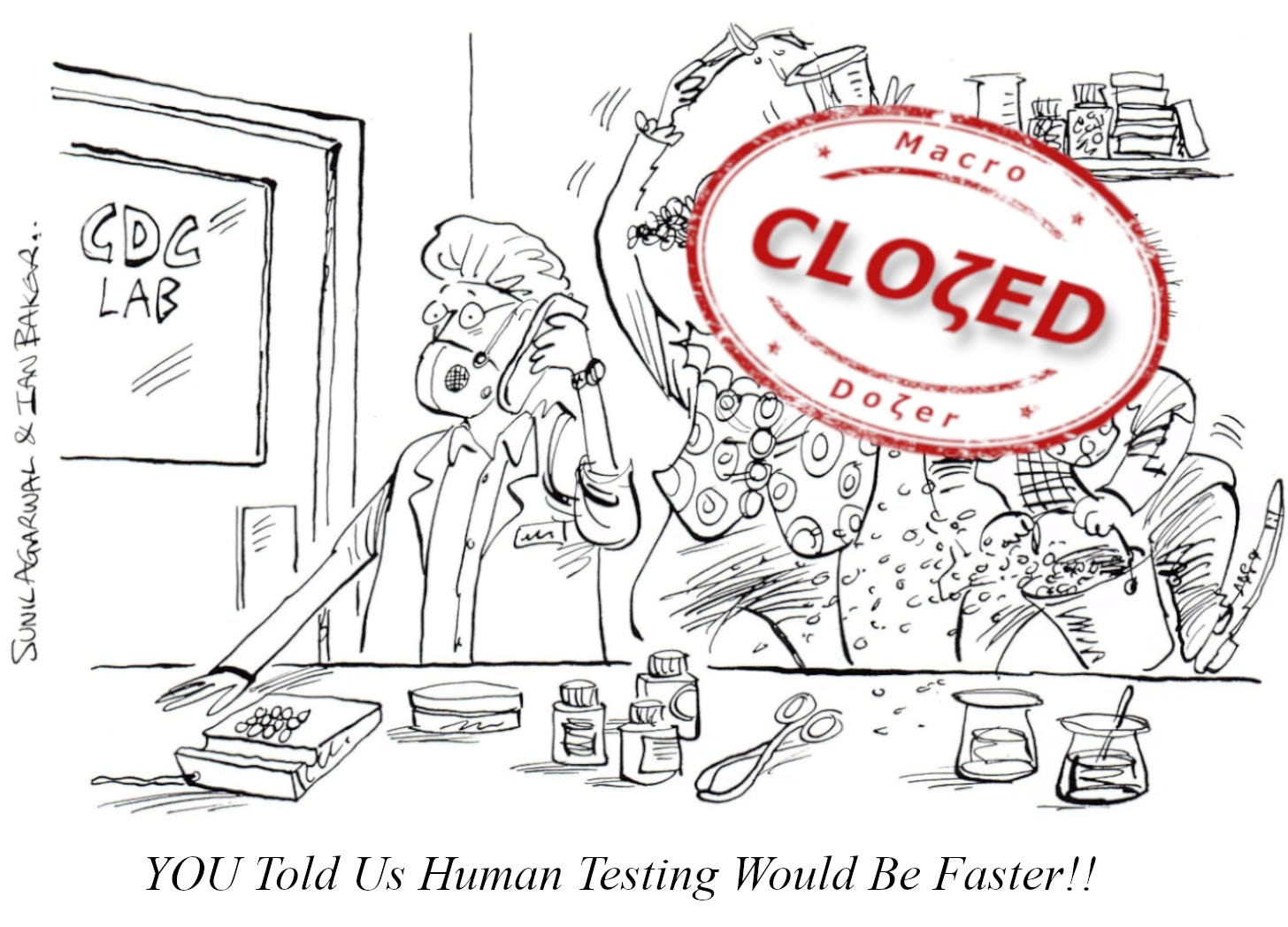

Christmas fatigue vs. drug testing on humans.

Both fire and chemicals can burn.

Implied volatility implosions plus profit zone landings are our favorite fireworks for 2023.

1. Recap Situation

We were a little tired of the pre-Christmas quiet and wanted to participate in drug testing on humans. So we immersed ourselves in the U.S. drug development process and philosophized about short-term chemical burns vs. burns from fire.

The journey was wild, as expected, but we survived, and our nerves are now stronger than steel. The risk-return setup helped us focus on what was important: to be patient and let the trade play out.

Check out the original BrainDoζer below.

2. Why Now?

All fun roller coaster rides have to end at some point. That point has come, and we are thrilled to have anticipated the maximum profit zone post-FDA approval at around ten. Implied volatility has imploded; options prices and their bid/ ask spreads have returned to earth, and we can buy back our risk-defined straddle for nearly half the price and realize a juicy return on risk capital.

We thank the FDA and TG Therapeutics for the new multiple sclerosis drug and wish everybody involved great success in commercialization. May our paths cross again sometime in 2023.

Happy New Year!

3. Trade Execution

3.1 Trade Entry - Dec 12, 2022

Total: 3.65 Credit.

3.2 Trade Exit - Dec 29, 2022

Total: 1.94 Debit.

The absolute return of this trade is

3.65 - 1.94 = 1.71

The capital used was 1.35, resulting in a return on capital of

1.71 / 1.35 = 126.7%