Spirit Airlines: Crafting Value in the Merger Maze

Financial Deep Dive, True Value, High Reward, and Holy Days.

Executive Tease

Financial deep-dive, that’s the spirit!

Merger mazings and true values.

One high-reward strategy.

Merry Christmas.

Driving Forces

It's been a long summer, taking us into the cold and foggy German forests, leaving the African sun behind. An extended summer that we desperately needed to launch a regional banking series on Seeking Alpha and develop customized live courses for options trading - a response to the demand for hands-on training for the strategies we discuss. To make them more accessible. So here we go.

We have also diligently searched for rich option premiums and recently found an exciting opportunity in Spirit Airlines (NYSE: SAVE). The options currently have an implied volatility of 100% at both rank and percentile. After experimenting with various strike prices and expiration dates, we have identified an attractive setup with a favorable risk/return profile supported by fundamentals consistent with our investment thesis.

Let’s go.

Investment Thesis

Our investment thesis for Spirit Airlines focuses on a strategic options trade that capitalizes on the high implied volatility of Spirit options amid the potential merger with JetBlue (NASDAQ: JBLU). This trade, a skewed, risk-defined straddle, is designed to profit regardless of the outcome of the merger. We have determined that Spirit's standalone market value should keep us above our breakeven point even if the merger is blocked or canceled. The expected value analysis of this trade shows a strong theoretical return, highlighting its consistency with our goal of exploiting market inefficiencies for above-average returns.

Company Insights

Spirit Airlines is a notable player in the airline industry, primarily recognized for its ultra-low-cost carrier model, offering a-la-carte travel options and unbundled fares. Its fleet, one of the youngest and most fuel-efficient in the U.S., serves various destinations in the U.S., Latin America, and the Caribbean.

In recent developments, Spirit has expanded its fleet and services, adding new aircraft and routes. The airline has received recognition and awards for safety and affordability.

A key ongoing development is the pending merger with JetBlue Airways, which is expected to conclude by the first half of 2024, although this is currently subject to a lawsuit by the U.S. Justice Department.

The chart below shows Spirit’s peer group ranked by total assets. A merger between JetBlue and Spirit would make them the fifth biggest US airline after Delta, United, American, and Southwest, with more than $22b in total assets.

Merger Update: JetBlue & Spirit Airlines

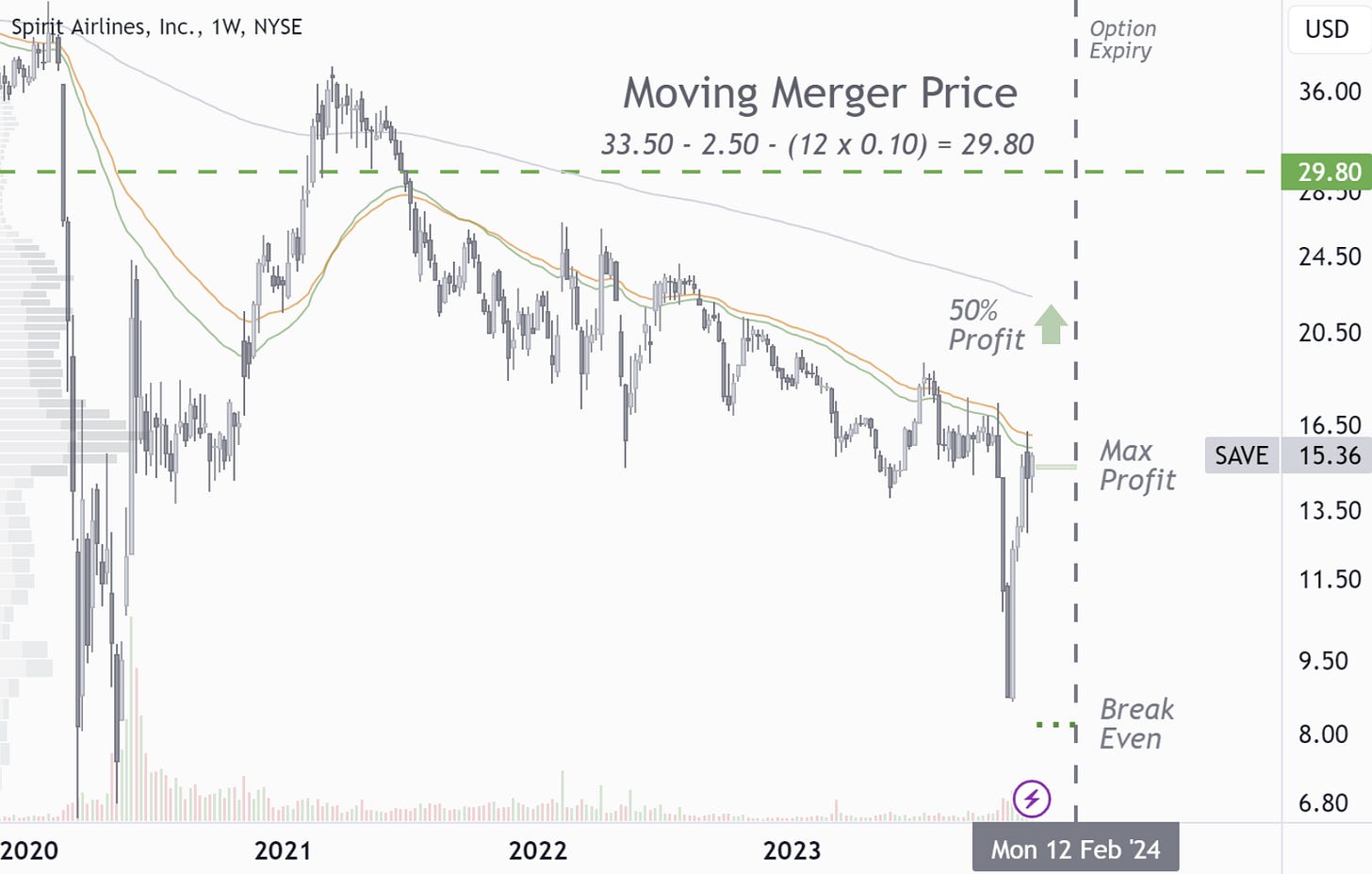

Financial Details: JetBlue's acquisition of Spirit is priced at $33.50 per share in cash, totaling a full equity value of $3.8 billion and an adjusted enterprise value of $7.6 billion. This agreement includes a prepayment of $2.50 per share following shareholder approval and a ticking fee of $0.10 monthly from January 2023 until the merger's completion.

Shareholder Approval and Legal Challenges: The shareholders approved the merger in October 2022. However, the U.S. Justice Department filed a lawsuit against the merger, arguing it would reduce competition and increase fares. This lawsuit focuses on eliminating the "Spirit Effect," known for keeping airfares low.

Current Legal Status: As of December 5, 2023, the trial has concluded with final arguments. Judge William Young is considering the case and has indicated the possibility of approving the merger if JetBlue agrees to divest more assets.

Potential Outcomes and Speculations: There is ongoing speculation about the conditions under which the merger might be approved. This includes the possibility of JetBlue being required to divest additional assets. The Justice Department remains concerned about the impact on price-sensitive consumers and the overall competition in the airline market if the merger is allowed to proceed.

Financial Performance

Let's examine the key financials, focusing exclusively on those critical to Spirit's valuation. The point is to identify Spirit's fair standalone market value if the merger is blocked or canceled to determine the bottom of a potential share price collapse should this materialize in the coming weeks. Currently, the share price is artificially inflated due to JetBlue's offer of $33.50 less the $2.50 prepayment, less the twelve times $0.10 ticking fee, i.e., an offer of $29.80.

Spirit has been posting losses since the world began trying to outdo China in authoritarianism while battling a SARS virus with flu-like symptoms for most. A great time for implied volatility junkies (and the wealthy) thriving on hysteria, power struggles, and clickbait. It’s been torturous for everyone else, including Spirit Airlines.

Despite these challenges, Spirit has invested heavily in its fleet and revenue growth, boasting an estimated overall revenue CAGR of 12% from 2017-2025E, as illustrated in the chart below. The airline is expected to break even by 2025.

The subsequent chart shows Spirit’s fleet growth and load factor. The company has maintained a relatively stable load factor despite an annual fleet growth of 10.3% since 2017. However, with most competitors having a load factor north of 85%, Spirit has room for improvement.

The airline is known for its substantial non-ticket revenue, serving a wider range of customers. However, the ticket revenue per passenger has been less promising, reflecting the challenge of balancing growth and market penetration with service quality. The trends over the years are depicted in the chart below.

When evaluating costs, we focus on relative rather than absolute figures, as the latter can be misleading in a growth environment. Spirit's primary expenses are fuel and salaries, visualized relative to revenue in the following chart. Both categories, with fuel costs at 33% and salaries at 30% of revenue, present opportunities for improvement.

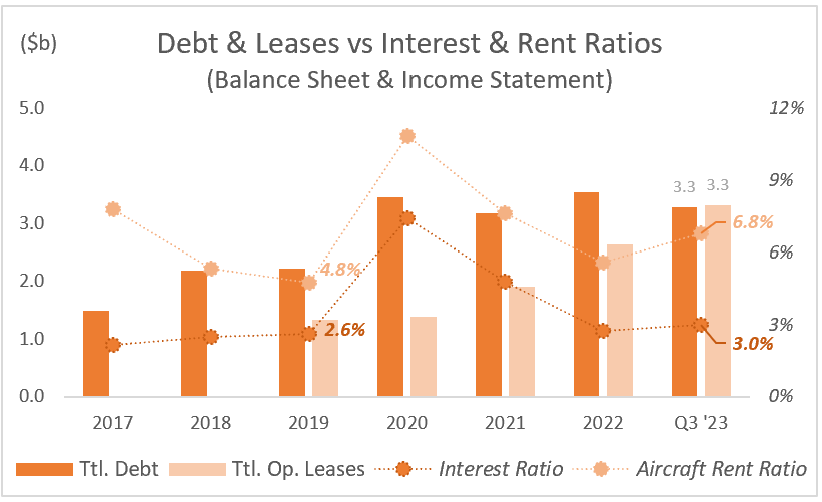

Spirit Airlines is not without leverage. Net debt and leases account for nearly 80% of the total enterprise value. These financing costs, at 3.0% and 6.8% of revenue, respectively, are stretched compared to pre-COVID levels in 2019.

Lastly, Spirit's cost per available seat mile is one of the lowest in the industry, thanks to its modern, fuel-efficient fleet. However, the company must increase revenues per available seat mile to return to profitability. This could be achieved by raising ticket prices and improving the load factor.

This brings us to the topic of solvency. Excluding 2020, Spirit’s average annual cash burn since 2017 was around $230 million. For 2023, our projection rises to around $330 million. Notably, if we exclude the cash burn from investing activities, the company has a positive average cash flow of $250m annually, and for 2022 and 2023 specifically, a reduced negative cash burn of $90 million only.

Assuming a future total cash burn of $300 million per year and one billion dollars in cash reserves, Spirit could feasibly remain solvent for another three years without borrowing new money, raising additional capital, or slowing down on investments.

Below, we show the development of Spirit's cash reserves in green and the quick ratio in orange. The latter, another interesting key metric that relates the most liquid part of current assets to all current liabilities, stands at 0.76x in 2023 and provides an additional picture of the liquidity situation.

Future Financial Outlook & Valuation

Before our multiple valuation analysis, let's examine the consensus growth projections for Spirit Airlines, which are essential for assessing its standalone valuation should the merger fall through.

The scatterplot below compares Spirit's projected revenue and earnings growth with its peers over 2023-2025E. Spirit is expected to outperform its peers with a significant annual EBITDA growth of 122% and a significant annual increase in total revenues of 10.5%.

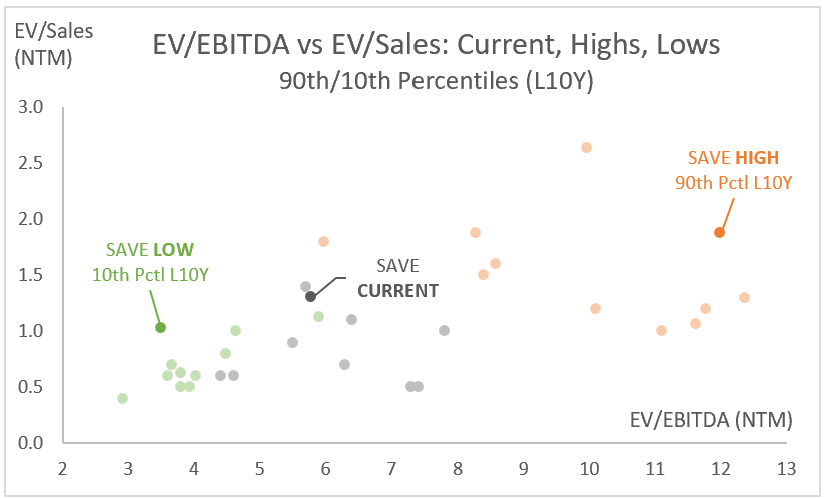

Our first valuation analysis in the chart below compares SAVE and its peers using EV/EBITDA and EV/Sales multiples. Current valuations are gray, while the orange and green dots indicate the 90th / high and 10th / low percentiles over the last ten years. All airlines are currently trading below their averages.

For Spirit’s EBITDA, we had to use 2025 projections since the company is only just emerging from negative territory here, and the next-twelve-month (NTM) figure is still too small, making the multiple not meaningful.

The following chart zooms in on the current market positions based on projected 2025 figures. SAVE is trading at the upper and "expensive" end of the EV/EBITDA and EV/Sales ranges compared to its peers, with multiples of 5.7x and 1.1x, respectively. This positioning can be linked to the company's leverage, leading to an elevated enterprise value, and an artificially elevated market value.

The following chart juxtaposes Spirit's price-to-book (P/B) and price-to-sales (P/S) multiples based on 2024 projections. Compared to its peers, Spirit is trading at a higher level, with its P/B ratio at 1.56x. In contrast, its P/S ratio is 0.29x, below the average for its peer group.

Verdict

Drawing on our analysis of multiple expansion and contraction and a comparative review against peers, we propose the following multiple ranges as the basis for setting a price target for the airline:

EV/Sales ‘25E: 1.15x-1.45x

EV/EBITDA ‘25E: 5.00x-6.25x

P/S ‘24E: 0.35x-0.40x

P/B ‘24E: 1.60x-1.90x

We can now apply each multiple range to today's share price and determine a fair price range for each metric. Ultimately, we suggest a share price target of $17.50, representing a potential upside of 14% from today's price.

Our share price projection does not end here. Read on under the 'Risk Assessment' section to see worst-case scenario projections.

Risk Assessment

In this section, we outline our main concerns about Spirit Airlines. For each of the areas, we present the specific risk (R), its impact (I), and mitigation strategies (MS).

Customer Satisfaction and Operational Performance

(R): Lowest ranking in customer satisfaction; high delay and cancellation rates.

(I): Decline in passenger preference and brand reputation; impact on revenue.

(MS): Improve customer service; enhance operational efficiency.

Financial Performance and Demand Issues

(R): Significant net losses due to softer demand and discounted fares.

(I): Threat to financial stability; impact on long-term profitability.

(MS): Diversify revenue streams; optimize fare structures.

Cost Control and Reduced Capacity

(R): Difficulty in managing costs; reduced capacity due to fewer plane deliveries.

(I): Lower operational efficiency and revenue.

(MS): Streamline operations; alternative fleet expansion strategies.

Credit Rating Downgrade

(R): Downgraded credit rating by Fitch Ratings.

(I): Increased borrowing costs; hindered access to capital.

(MS): Strengthen financial performance; improve debt management.

Merger Uncertainties with JetBlue

(R): Pending lawsuit against the merger with JetBlue.

(I): Uncertainty in strategic direction and market positioning.

(MS): Prepare contingency plans; maintain operational independence.

Operational Disruptions

(R): Adverse weather, worker shortages, technical glitches.

(I): Decreased reliability; customer dissatisfaction.

(MS): Enhance workforce management; upgrade technical infrastructure.

Worst-Case: Share Price Projection

Our worst-case analysis indicates a potential 43% decrease in Spirit Airlines' share price to $8.8, based on conservative multiples from historical lows during challenging periods. This projection, detailed in the chart below, considers the risks identified earlier, including financial and operational challenges.

Trade Execution

This trade setup is not only intriguing from a risk/return perspective, it is also visually appealing. The expiration date is early next year, so feel free to throw it under the Christmas Tree. You are welcome.

Trade Entry - Dec 15, 2023

We are selling a skewed risk-defined straddle at strikes 15.00, with wings at 5.00 and 20.00, maturing on Feb 16, 2023. The break-even point is at 8.25.

The options chains are relatively liquid, but the bid and ask spread is wide, so we got filled slightly below mid-price.

Total: 6.75 Credit.

Option-Specific Trade Risks

Price: High to moderate risk of the underlying price rising to the agreed level or falling near/below our break-even point, especially if the merger outcome is confirmed.

Volatility: Moderate to low risk of implied volatility increasing beyond current high levels but a high risk of it remaining elevated.

Assignment: Low risk for short call assignment. It may become moderate if the price rises without a quick merger resolution, though manageable with some extra transaction costs.

Expected Value

The expected value (EV) indicates the expected profit (or loss) if you make the same trade indefinitely.

Expected Value = (Probability of Profit * Expected Profit) - (Probablity of Loss * Expected Loss)

We aim to create an edge by integrating macro, micro, and technical analysis, identifying mispriced options contracts, and applying effective trade management to tip the odds in our favor.

Expected Value for Short Straddle (Risk-Defined)

Within our set timeframe, we have identified three primary scenarios, along with their respective probabilities:

No Merger Decision: The share price stays close to our maximum profit - 33% probability.

Merger Approval: The share price rises above 20 - 33% probability.

Merger Blockage or Cancellation: The share price drops to between 6 and 10 - 33% probability.

As illustrated in the table below, when these outcomes and probabilities are applied to our trade payoff, the expected value on equity results in an impressive 60%. This figure represents an exceptional theoretical return.

Closing Chapter

You should expect updates on most articles within 4-6 weeks. We use the exact headline ending with (+/- xy%) and mark the cover cartoon with a red CLOζED stamp. This way, the performance is easy to track.

We only send updates via email if you specifically ask for them here. We want to keep the flow of information short and sweet. However, you can still access a free preview of all updates on MacroDozer as soon as they are released.

My name is Juri von Randow. You can find me on the top banner to the right, MacroDozing like there's no tomorrow. (Email version only.)

Feel free to pass me on. Warm regards.

All articles are purely educational; they are not tailored to any particular individual or portfolio and do not constitute investment advice. Let us know if you are interested in implementing any of our ideas. We can help or point you in the right direction.