ROYAL CARIBBEAN CRUISES: Obstacle Cruise (-1%)

Enthusiasm, Textbook, Professorship, and Fish.

Executive Summary

Enthusiasm could open up a Chair: We went textbook on RCL!

The Obstacle Cruise ends with no significant casualties.

No one seems safe from the concept of mean reversion.

1. Recap Situation

Not everyone will be as enthusiastic as we are right now. But if we were Associate Professors in the Field of Derivatives Studies, they would have to make us professors with immediate effect. Royal Caribbean Cruises - RCL: Obstacle Cruise - we even got the title right!

Despite all the celebrations, we must face the fact that we still booked a slight loss. It's good to check in with reality once in a while. Nevertheless, we steered Titanic's cousin from the iceberg of total loss back to shore, with close to zero damages and no human casualties.

It won't always be that easy to fight and repair losing trades, but we're pleased to report that our first MacroDoζer Trade UPDATE Series went textbook.

Check out the original BrainDoζer below. And find the links to the trade updates here: UPDATE and UPDATE II.

2. Why Now?

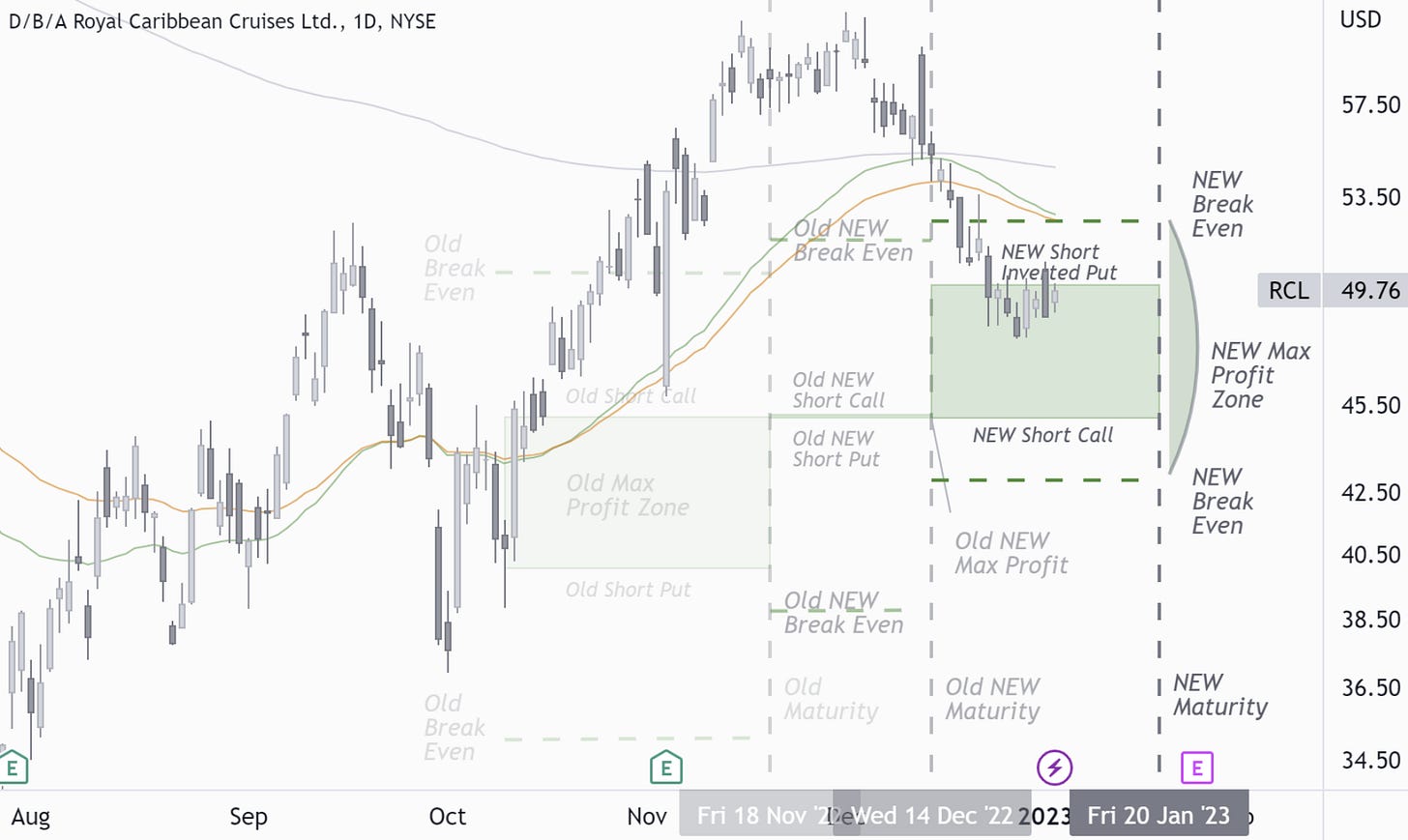

Royal Caribbean Cruises does have come across the concept of mean reversion after all. A picture is worth a thousand words; we got four of them, which will clarify any doubts about timing.

2.1 Trade Entry - Oct 7, 2022

RCL: Trade Entry - Short Strangle (Risk-Defined) / Iron Condor.

2.2 Trade UPDATE - Nov 1, 2022

RCL: Trade UPDATE - Adjusting Trade, Rolling Up Put Side, And Rolling Into Next Month For Additional Credit.

2.3 Trade UPDATE II - Nov 25, 2022

RCL: Trade UPDATE II - Adjusting Trade, Rolling Up Put Side, And Rolling Into Next Month For Additional Credit.

2.4 Trade Exit - Jan 4, 2023

RCL: Trade Exit - Long Inverted Strangle (Return-Defined) / Single Wing.

3. Trade Execution

3.1 Trade Entry - Oct 7, 2022

Total: 5.25 Credit.

RCL: Pay-Out Graph Short Strangle (Risk-Defined) - Sell To Open.

3.2 Trade UPDATE - Nov 1, 2022

Total: 6.60 Debit.

RCL: Pay-Out Graph Long Strangle (Return-Defined) - Buy To Close To Roll Into Next Month.

Total: 7.70 Credit.

RCL: Pay-Out Graph Short Straddle (Risk-Defined) - Sell To Open To Roll Into Next Month.

3.3 Trade UPDATE II - Nov 25, 2022

Total: 8.80 Debit.

RCL: Pay-Out Graph Long Straddle (Return-Defined) - Buy To Close To Roll Into Next Month.

Total: 9.60 Credit.

RCL: Pay-Out Graph Short Inverted Strangle (Risk-Defined) / Broken Wing - Sell To Open To Roll Into Next Month.

3.4 Trade Exit - Jan 4, 2023

Total: 7.20 Debit.

RCL: Closing Pay-Out Graph - Long Inverted Strangle (Return-Defined) / Single Wing.

The total net return of this series of rolled and now closed trades is

Trade Update: (5.25 - 6.60) + 7.70 = 6.35 Trade Update II: (6.35 - 8.80) + 9.60 = 7.15 Trade Close: 7.15 - 7.20 = -0.05

The initial capital at risk was 4.75, resulting in an overall negative return on capital of

-0.05 / 4.75 = -1.05%

You may wonder why we still have a slightly negative return even though the stock price trades within the break-evens and maximum profit zone.

The more you roll options into the money and the more you invert, the slower the options product reacts as a unit and the more it wants to be held to maturity. We are also seeing a slight increase in implied volatility, which keeps option prices elevated.

We could hold the trade longer, let more theta burn, and bet on another decline in implied volatility. However, the gamma risk is getting higher by the day, and we look forward to returning to the marina and eating the fish we caught on our cruise.

Petri Heil.