MARATHON DIGITAL: MacDoζe Winter-Blows 2/4

Fraudsters, Inflation, Crypto Miners. We just sold our last FTT as NFT.

Executive Summary

Will investing still be fun with more rules and fewer fraudsters?

Inflation could make you wealthy. Think about it.

We dive into the week alongside crypto miners; in straddle formation, believe it or not.

1. Why Do I Care Right Now?

So should we consider investing money the old-fashioned way again? Regulated markets, SEC oversight, a limited amount of fraudsters, and complete control over data, probabilities, and risk returns. It sounds a little boring, I know. But consider the flip side of that old coin. As long as our governments don’t file for bankruptcy, our fiat money is safe, and we can move in and out of projects, investments, or other stores of value for relatively low costs and calculated risks.

Rant Around Inflation Minimalists

A little inflation, let’s say between 2-8%, has never damaged any economy. On the contrary. Plentitudes of wealth locked away in unproductive ways not circulating within real economies can find its way back into the pockets of the general, mainly younger and working population, through higher wages and debt relief. A desperately needed side effect of inflation that contributes to economic growth and peaceful wealth redistribution from top to bottom. We need the general population to be productive and able to spend.

If you fear for your cash savings, make sure you and your money are put to use productively, if feasible debt-leveraged so you find yourself on the right side of inflation. We don’t recommend gambling or leveraged investing via your bank. Good luck finding a financial advisor. Dopamine and cortisol do not beat the market.

Why not put your money where your passion is? It might make a fulfilling journey and a fun story. Let’s not outsource the allocation of funds to mediocracy when it is our own responsibility.

ॐ, ओम्.

We like low costs and calculated risks. And since everybody now is talking about how fraudulent the crypto space is, why not go with the flow and burn some more theta or go directional on other crypto exchanges?

1.1 Top Crypto Exchanges By Volume Year-To-Date (in USD billion)

The only problem here is that Coinbase is the sole publicly listed crypto exchange, and we are not sure if we like to play this one (yet). In addition, it has lazy strike pricing, meaning there are only a few strikes to choose from, especially on the lower end. Suspicious. For a company swimming in a troubled industry, we want to see strikes available close to zero. The lowest currently is twenty-five.

Otherwise, we could trade coin options on crypto exchanges. That would be like shorting Bear Stearns or Lehman Brothers in 2008 on their own brokerage accounts. Do we want to outsmart the bug on its own operating system? How much of a hero do we need to be? Some hedgies tried that on FTX and are co-creating a terrible play.

Only the angels in the clouds know what all residual exchanges are up to and if they follow the real-world rules of having customer funds and their own assets fully segregated.

Side note: an exchange run should not be a thing. It is illegal for an exchange to touch customer cash. On the other hand, bank runs can be a thing where up to 90% of customer deposits are used for loans and will not be available for immediate withdrawal.

A clear no to trading coin derivatives on crypto exchanges.

What about crypto miners? We like the idea of playing the miners. The big ones are publicly traded and have solid option chains with plenty of liquid strikes and high implied volatility. Falling coin prices, elevated energy costs, ever-decreasing barriers to entry, and significant potential headwinds from governments and societies do not sound like a recipe for quick share price recovery.

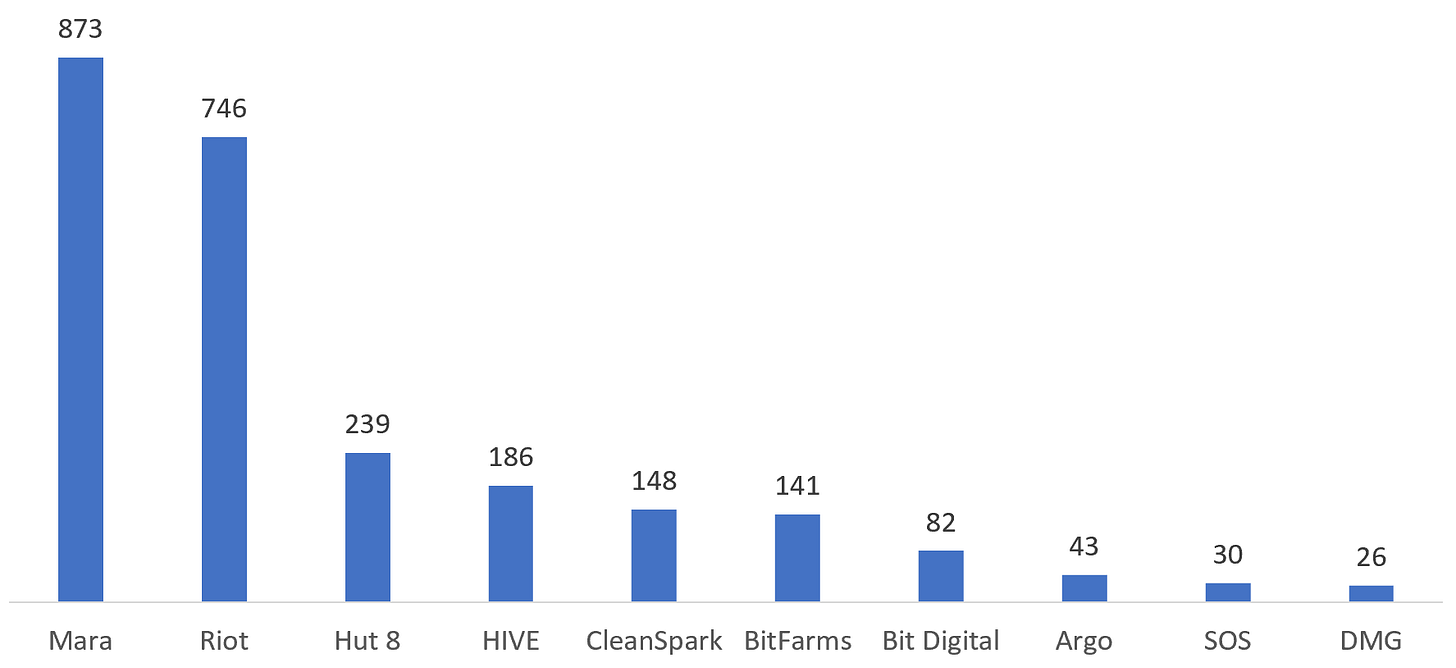

1.2 Top Crypto Miners By Market Cap (in USD million)

Our favorite is Marathon Digital (MARA). Let’s go for the big girl. It is the only one still trading above five and the most likely to stay afloat while others could drift away. We play it short but within a range. So bankruptcy would be a loss for us, too, with no opportunities to adjust the trade.

2. Useful Background Information

Marathon Digital is headquartered in Las Vegas. That’s the only useful background information relevant to the trade.

3. Trade Execution

We are selling a bearish risk-defined straddle at 5, with only one wing to the upside at 10, maturity Jan 20, 2023. The second wing is unnecessary since it would increase the risk instead of decrease it. MARA at zero would mean we lose less than our overall maximum risk involved to the upside.

Break-evens are at 2 and 8.

3.1 Trade Entry - Nov 21, 2022

Total: 2.96 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDoζer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.