GAMESTOP: When Will The Game Stop (+97%)

Not hope, but pure gut calculation.

Executive Summary

The game stops right here for us.

Upbeat earnings did mean downbeat price.

Butterfly spirits at twenty bucks flew us closer to bliss.

1. Recap Situation

We showered the Fed, regional banks, and the entire financial regulatory system with sympathy for their inability to deal with the most complex financial instrument, cash.

We also expressed affection for Racket Ryan, Cohen the Barbarian, the Ruler of Retail, and his courage and investment genius. Is he behind the recent sharp sell-off that we bet on? Unthinkable.

Our expected value on equity for this episode of fun and enjoyment was 53%; we turned it into an actual return on equity of 97% in five weeks.

Check out the original BrainDozer article below.

2. Why Now

The option contracts mature in 18 days. We do not want to risk further short-term price squeezes or a continuation of the sharp price drop, as it becomes increasingly challenging to repair trades as contract maturity approaches. Perfect timing, perfect zone.

3. Trade Execution

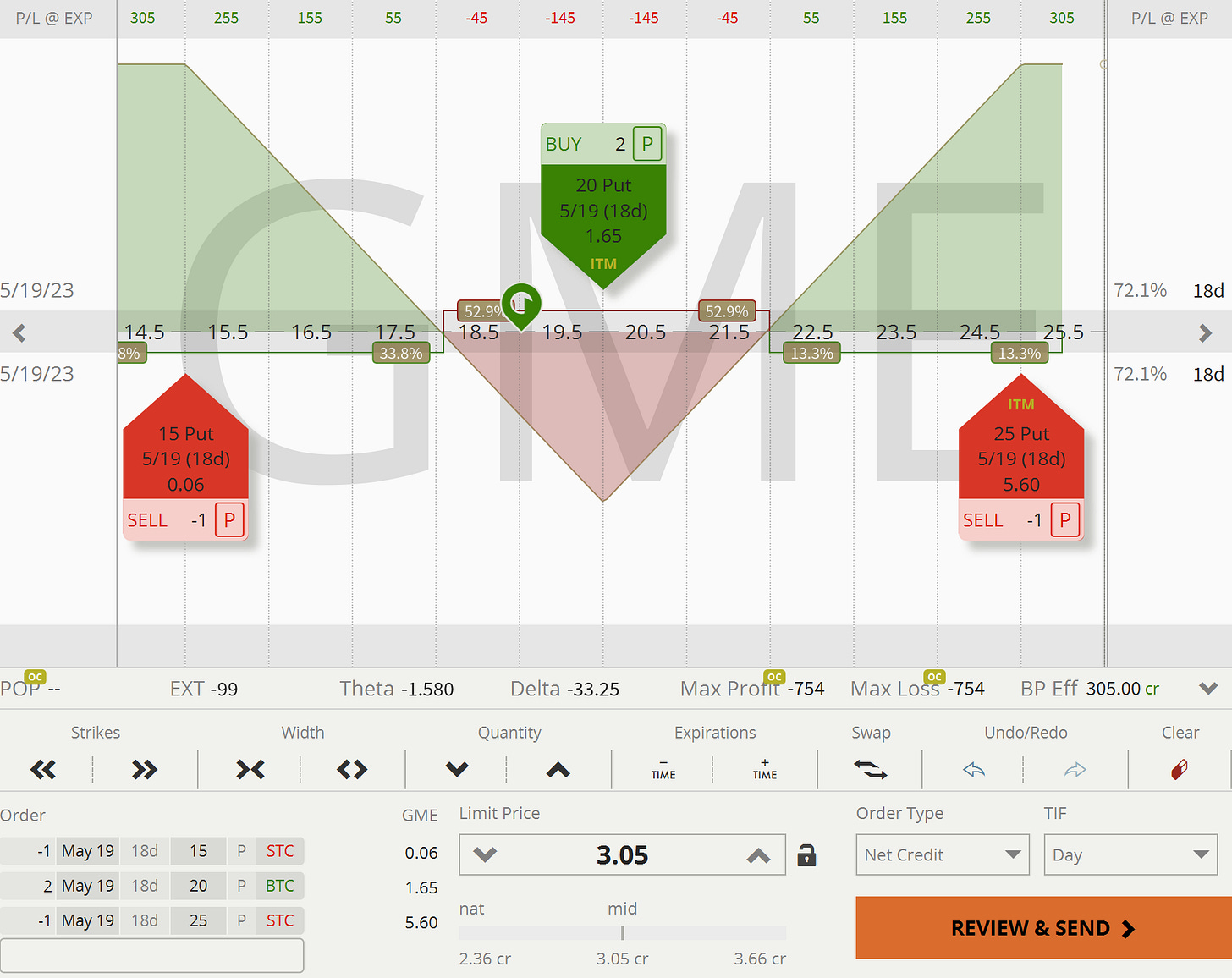

For the first time, we bought a put-only butterfly instead of selling our usual risk-defined straddles or strangles, which include the put and the call side. This way, we eliminated assignment risk from potential in-the-money short calls.

The butterfly works the other way around: you buy the maximum risk at the edges in red for a debit and sell the green edges closer to maturity for a credit. See below the trade entry and trade exit payout graphs.

3.1 Trade Entry - Mar 24, 2023

GameStop has very liquid option chains. As a result, we were filled right in the middle between the bid and ask price, despite the relatively large spread.

Total: 1.45 Debit.

3.2 Trade Exit - May 1, 2023

We were filled at an average price of 2.85, slightly below the mid-price.

Total: 2.85 Credit.

3.3 Trade Return

The absolute return on this trade is

-1.45 + 2.85 = 1.40

The equity at risk was 1.45, resulting in a return on equity of

1.40 / 1.45 = 96.6%

All BrainDozer articles are purely educational; they are not tailored to any particular individual or portfolio and do not constitute investment advice. Let us know if you are interested in implementing any of our ideas. Perhaps we can help or point you in the right direction.