JUNIOR GOLD MINERS: The Art Of Gold Digging

Who Said Mining Was Unfunny Business?

Executive Summary

Gold, gold miners, treasury bonds - we dig premium.

Find out why gold diggers smile.

1. Why Do I Care Right Now?

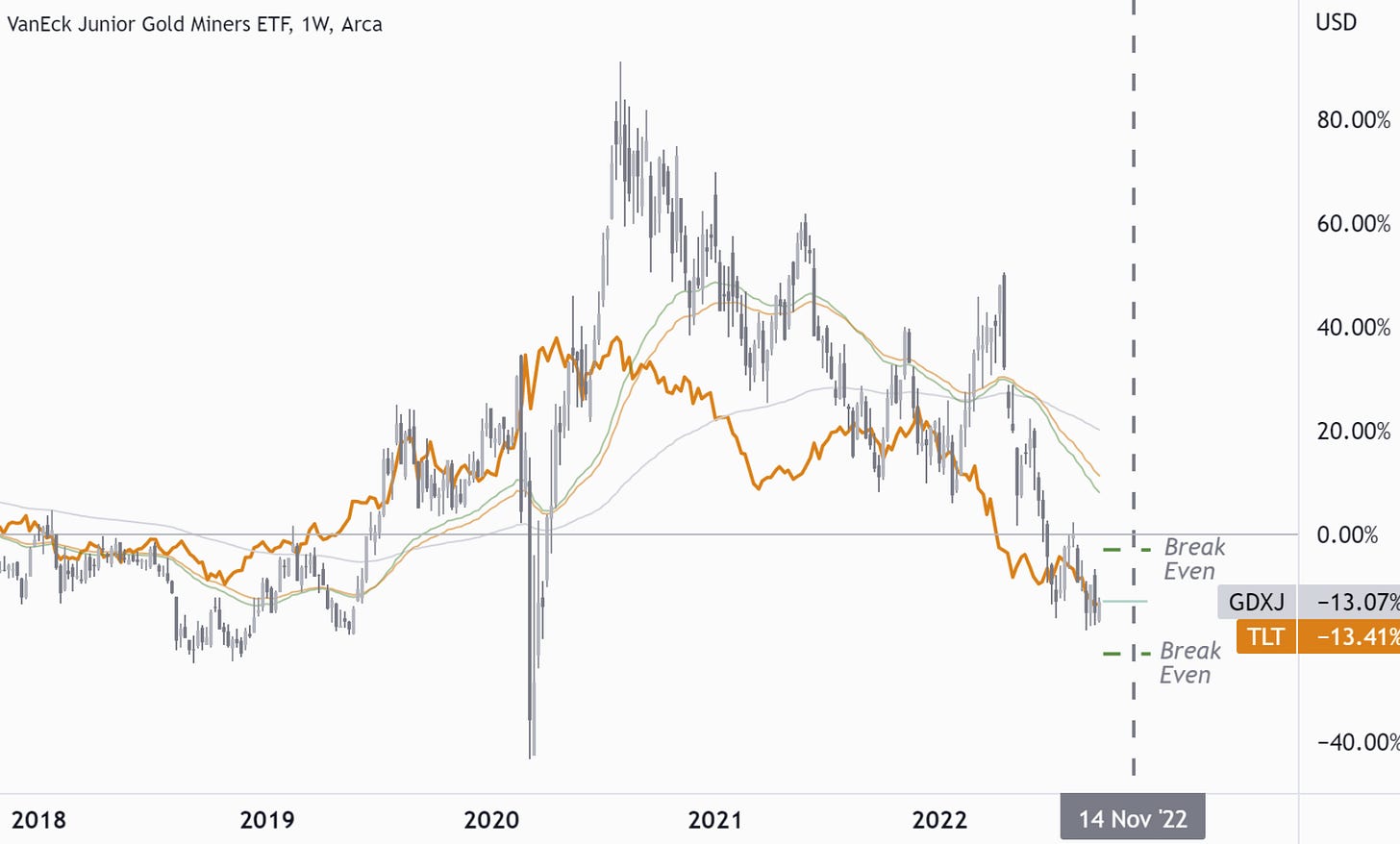

Forward-looking indicators on inflation are showing signs of cooling. As a result, voices about US treasury bonds becoming an investment opportunity are getting louder. To a certain extent, Gold (GLD) and gold miners (GDXJ) are correlated to interest rates and treasury bonds (TLT). We believe a temporary bottom could be in and bet on a rangebound sideways move from here.

Implied volatility for GDXJ stays elevated throughout today’s Fed minutes, our break-evens are more than ten percent away from the current spot, and we do not have to use much capital relative to maximum profit. We believe long-term technical support at 26 makes a short-term risk to the upside more likely. Remember, historical market behavior and its participants have memories.

2. Useful Background Information

Options trading on gold as a commodity (GLD) or gold miners (GDXJ) differ slightly from trading options on regular companies.

Generally, the market assigns various degrees of risk (implied volatility) to various future price developments.

For regular companies, market participants assign more risk to crashes than rallies. Hence, they are happy to pay a higher price for put options that serve as insurance or hedge against falling prices. More fear and more demand equal higher prices.

In contrast, upwards trending markets usually evolve more orderly with less velocity. As a result, less fear and less hedge demand for the upside mean lower prices for call options. An additional factor for lower call valuations is elevated supply; the broadly employed Covered Call strategy floods the market with cheap call options.

Now back to gold and gold miners. Market participants assign the same risk to a gold rally and a gold crash. The more extreme the price moves, the higher the implied volatility measures for both, puts and calls.

We call that the gold smile of implied volatility. We can neglect the smile for today’s trade execution, but we might want to revert to it when we employ more complex strategies. Regardless, now we know why that gold digger looks so funny.

Generally, we don’t believe gold miners qualify for a promising long-term investment, so there is no need to understand the GDXJ product deeper. Yet, if you are curious, check out the official website.

GDXJ option chains are sufficiently liquid. Therefore, we are happy to sell pricey premiums and get back to you in about 30 days.

3. Trade Execution

We are selling a slightly bullish risk-defined straddle at 30, with wings at 25 and 35, maturity Nov 18, 2022.

Break-evens are at 26.5 and 33.5.

3.1 Trade Entry - Sep 21, 2022

Total: 3.35 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.