BRAZIL: Brazil for President! (+30%)

Surrendering Does Pay Off Once In A While, Hallelujah

Executive Summary

Alive we are, we take the gift.

We close the trade pre-election result.

Not much volatility contraction, yet thirty per cent will sweeten the Xmas show.

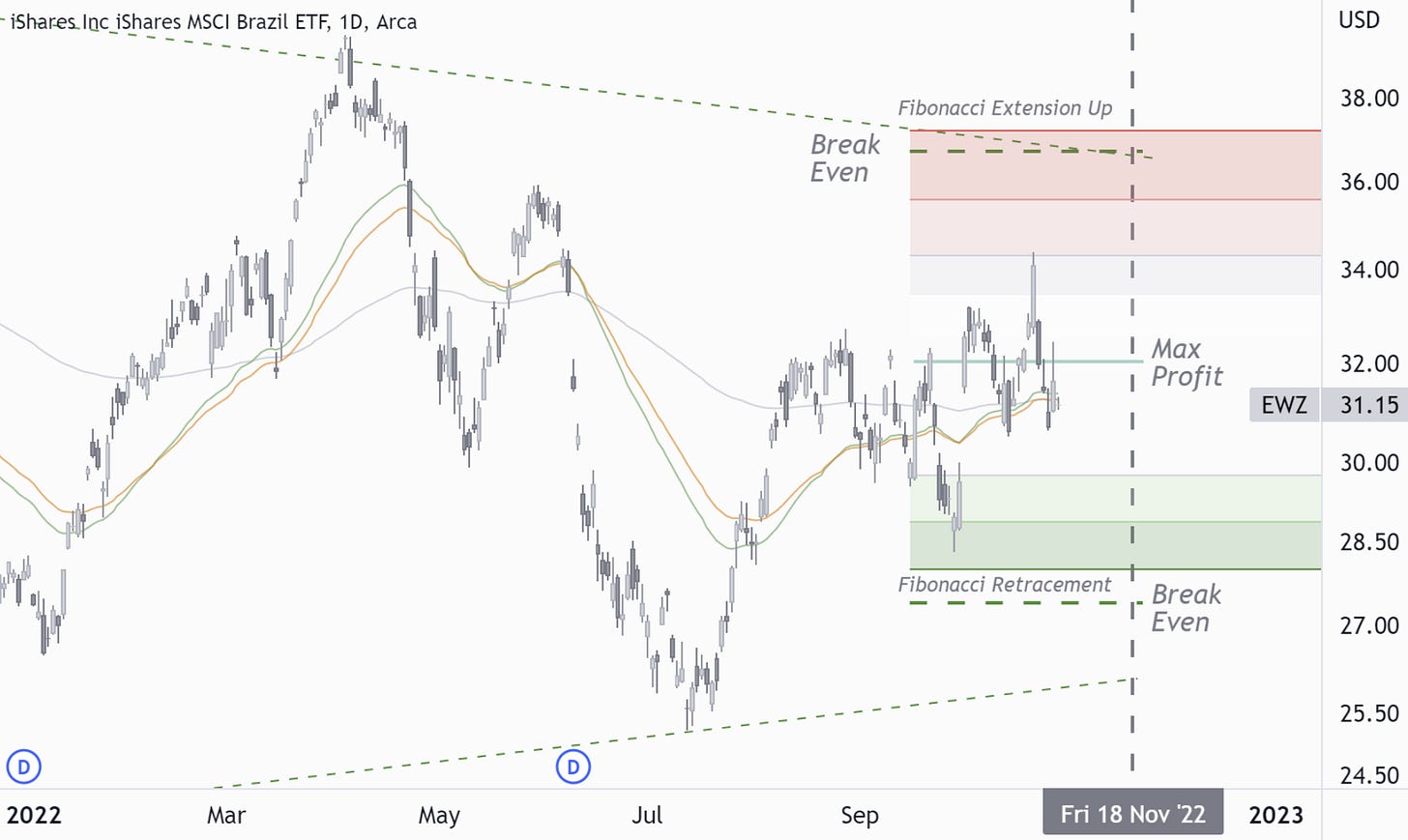

1. Recap Situation

We took the time and cared for Brazil; we felt alive and participated in the dance of divinity. Witnessing Lula and Bolsonaro telling the truth in a sauna club, Rio De Janeiro, made us seal the deal. We have been selling premium on Brazil ever since.

We were betting on a narrowing funnel into election month, and a narrowing funnel we got. If you are a triple long-term investor, you might consider going long from here. The cost will be giving up control and handing over money to hope and believe. We certainly will not, but we also won’t judge if you do.

Check out the original BrainDoζer below.

2. Why Now?

It is time to close the trade. Twenty-one days to contract maturity, and on Monday, we could witness a big swing in the underlying asset resulting from Sunday’s second and final election results. Implied volatility has not contracted, flagged before trade entry as a small risk. Instead, it increased throughout the trade. We are still glad we took our chances and could participate in the election thrill.

Also, we do not believe in the odds of lottery play and try to focus on steady wealth creation. A thirty percent return on equity in less than two months is still above average.

Farewell, Brazil, for now. We will potentially revisit this soon.

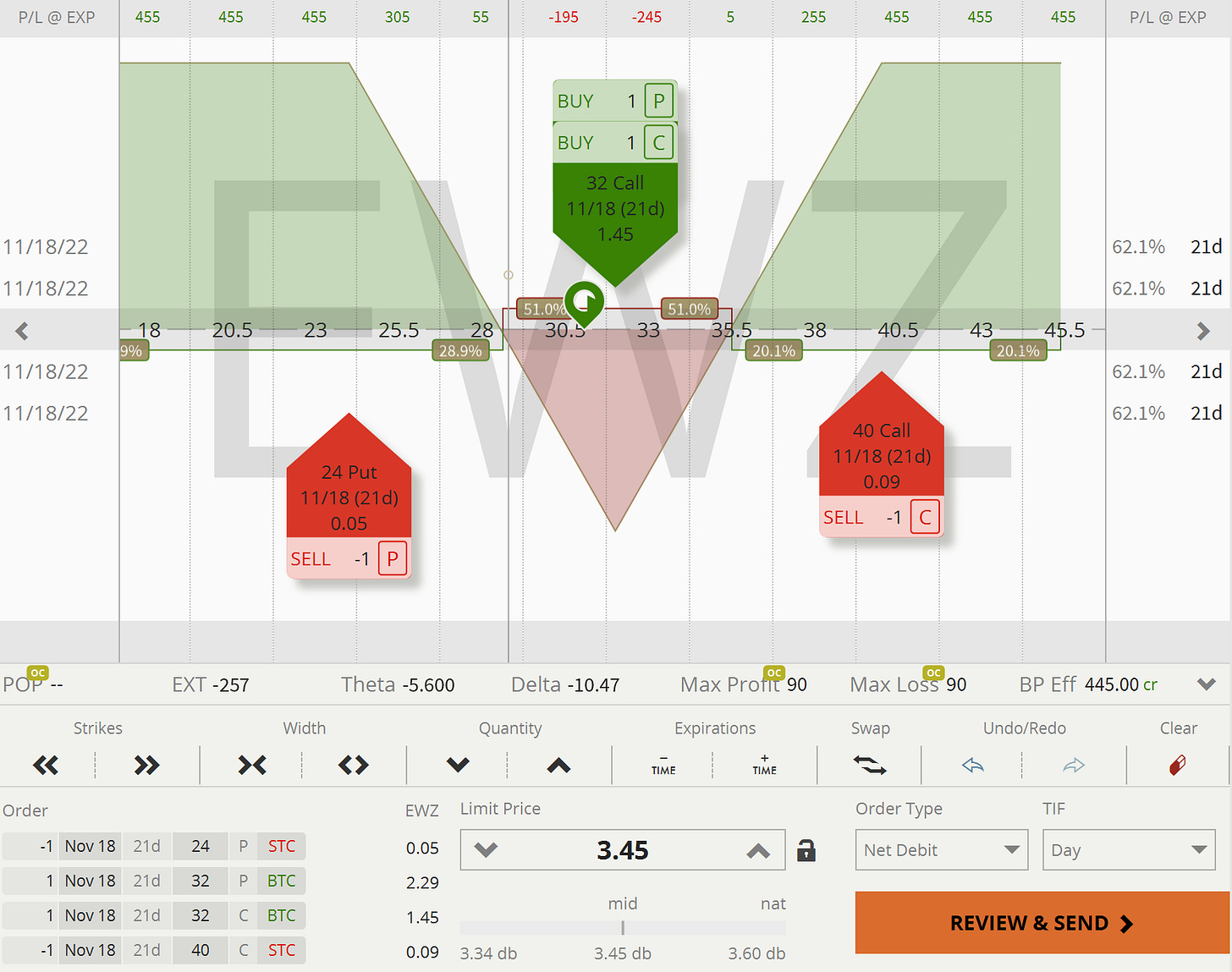

3. Trade Execution

3.1 Trade Entry - Sep 13, 2022

Total: 4.50 Credit.

3.2 Trade Exit - Oct 28, 2022

Total: 3.45 Debit.

The absolute return of this trade is

4.50 - 3.45 = 1.05

The capital used was 3.50, resulting in a return on capital of

1.05 / 3.50 = 30.0%