BEYOND MEAT: A Bite Into The Hype

Green Gets Grilled.

Executive Tease

n=1 makes for a good anecdote.

When Large Language Models don’t replace the COVID narrative.

We tried the burger and keep it neutral.

1. Driving Forces

Anecdotal evidence makes for entertaining stories. So, why bother with the n=1 problem? The appeal lies in simplicity: we can dispense with the concept of controlled trials, there's no need for expensive participants or equipment, and here is the kicker, no laboratory environment can affect the outcome.

Let me illustrate: Last summer, I was offered a Beyond Meat burger. The taste wasn't too bad, but half an hour later, I felt sick. Maybe my Caucasian gut microbes had other challenges to overcome that night, but I didn't dare try this meat alternative again.

We believe it's time to recoup that investment, whether or not this is sufficient proof. And to be honest, we strive to profit beyond anecdotes and chemically-processed proteins, so we allow ourselves to focus solely on money flows and business fundamentals.

Beyond Meat (BYND), one of the market's most shorted stocks, with a 30-40% short interest, is a hotbed for short-squeeze specialists. These buy up out-of-the-money calls, forcing short sellers to cover and drive the price up. Additionally, it is an emotional asset with a passion-driven following that might be willing to invest beyond the usual boundaries of financial prudence for the causes of veganism or climate change.

We derive great pleasure from tracking emotional assets at the Doze, as they offer engaging content and intriguing risk returns. When the intensity or drama starts to wane and the popcorn is depleted, we anticipate a temporary period of stability or a return to the mean.

Let’s go.

2. Background Information

Since 2009, Beyond Meat (BYND) has sought to transform the meat industry with plant-based alternatives, contributing to the climate change debate and the global move towards sustainable, health-conscious food.

The company has made great strides since going public in 2019. Its products, designed to reflect the taste and texture of traditional meats, are available in many US American and international retail chains.

However, BYND's growth and profitability have been challenged by weak demand, high prices, waning consumer interest, saturated US distribution, and potential spoilage from high inventory. Financial issues like significant debt and cash flow difficulties worsen the situation, with the unsuccessful launch of Beyond Meat Jerky and potential distribution issues raising further concerns.

2.1 Valuation

A company in the packaged food and meat industry is deemed overvalued when its enterprise value is 5.1x its sales. This situation becomes particularly alarming when the company, besides making losses, is heavily indebted and undergoing a decline in sales. The industry's median multiple is just 1.8x, a significant 75% below BYND's valuation. Notably, more than half of these companies manage to generate profits.

EV/Sales Multiple Near Upper 52W Trading Range

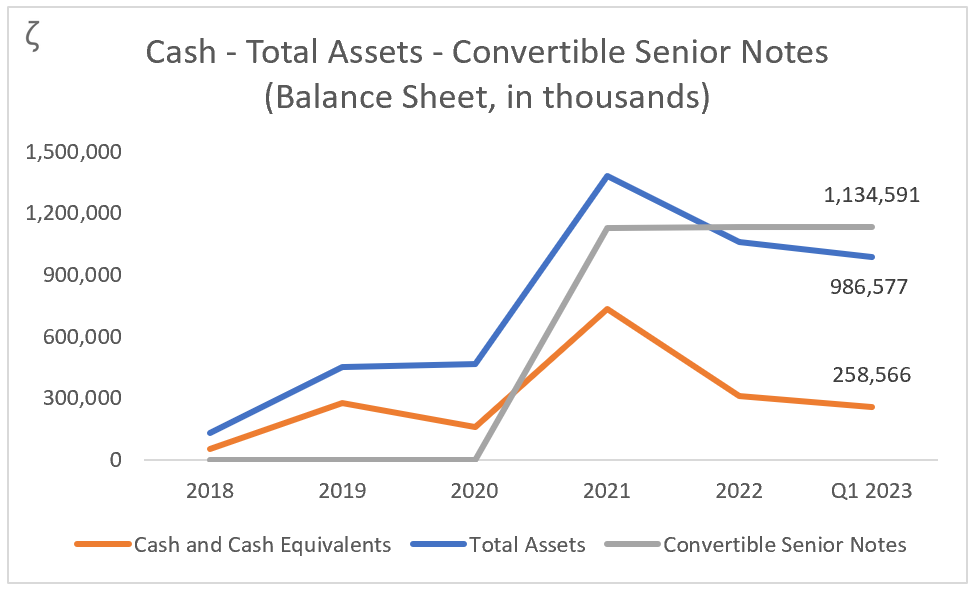

BYND's enterprise value comprises its $1.1 billion market capitalization plus $1.2 billion in debt minus $260 million in cash. A 75% drop in enterprise value would result in a theoretical 'sub-zero' stock price. What a blessing - no public shareholder is personally liable.

The chart below illustrates that total assets are primarily driven by the senior convertible notes issued in 2021. However, the plot thickens in 2022 when total assets trailed behind these notes, thus plunging us into the thrilling realm of negative equity - how fun!

Total Assets Trailing Behind Convertible Senior Notes

Cash and cash equivalents are set to run out this year, and we're sceptical about how easy it'll be to secure more money through additional debt financing.

New funds to support the loss-making venture will most likely be generated through the recently established at-the-market issuance facility managed by Goldman Sachs. This provides another financially unremarkable asset for Goldman Sachs to promote; after all, they need to generate their commissions somehow. What better way could there be than by selling overpriced assets to the public under the pretext of combating global warming?

The prospectus (May 10, 2023) reveals an authorized issuance of $200 million in new shares for equity dilution, likely to exert additional downward pressure on the share price in the latter half of 2023. At the very least, it's improbable that short squeezes will catapult values to astronomical heights.

2.2 Growth

The idea that COVID is still being blamed for the company's problems in the Q1 2023 report raises eyebrows and leaves a sour taste. Large Language Models are the latest buzzwords, dah! So, if management is still clinging to the COVID narrative, it's time they shake it off, leverage ‘AI’, and shift the focus from whining to producing results.

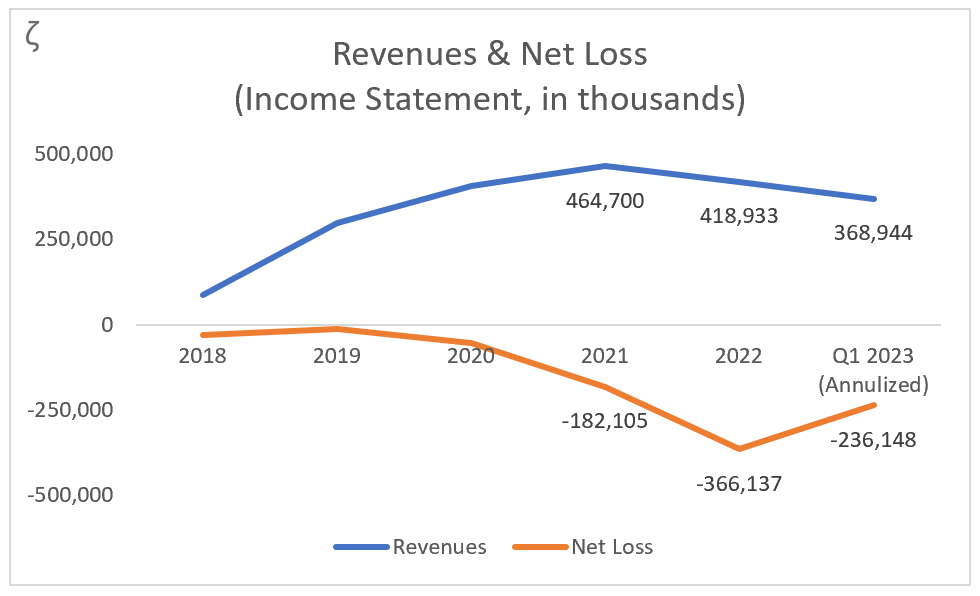

The chart below indicates revenues are declining - hardly reassuring for a purported growth company. Moreover, we're incurring losses. While the projected figures for 2023 are not seasonally adjusted, they certainly assist in sensing the larger trend.

Revenues Decline - Losses Remain

To boost sales, it will be necessary to invest more heavily in research and development, enhancing existing products and devising new ones. This investment, coupled with the expense of comprehensive marketing and sales campaigns, will likely continue to exert pressure on profits.

2.3 Earnings Revisions & Profitability

Year-end earnings per share have been revised upwards ten times and downwards only once in the last three months. Sales, however, have been a mixed bag, revised upwards three times and downwards seven times. Nevertheless, this suggests a small potential for a positive earnings surprise.

The chart below indicates that the accumulated deficit continues to accrue and that equity is in negative territory – ouch!

Negative Equity - Accumulated Deficits

At this juncture, it may seem unkind to delve into a Rant Around concerning management's political tactics to preserve the planet, considering their current predicaments. However, a little philosophical diversion is, sometimes, exactly what we need to stay sane. Feel free to skip ahead.

Rant Around Tactics of a Planetary Conservationist

While pursuing planetary conservation and social justice is admirable, it can occasionally be obstructed by a blind adherence to overly simplistic ideologies, restricting independent and profound thinking. Sometimes, activism is more preoccupied with lamenting grievances rather than devising intelligent and practical solutions. There might even be an excessive tolerance for suboptimal solutions in the name of climate change to prevent mob outrage or cancellation demands.

Consider the case of plant-based processed foods renamed as ‘meat’ – a suboptimal solution that, while tolerated, may mislead and harm. This play on words can cause consumer confusion, further dissociate the term meat from its animal origin, potentially expose consumers to unexpected allergens, and engender a less transparent society. Picture being served a steak, only to discover it was composed of potatoes and legumes, coupled with the typical downsides of processed foods like emulsifiers, stabilizers, and sugars, which hardly contribute to a healthier lifestyle.

In its unprocessed form, meat is one of the most nutritious and least allergenic options available. There's no need to dabble with the definition. If a new name is required for plant-based alternatives, I'm confident that language models such as ChatGPT, Bard, or Perplexity could provide various suggestions if creativity falls short.

Bon appétit.

3. Trade Execution

Unfortunately, the share price has already experienced some mean reversion over the past couple of weeks, and it appears poised for another little rally into the next leg. Regardless, implied volatility remains high, and options premiums have not deflated due to the upcoming earnings event.

In a sense, this trade has now partially become an earnings play. Nonetheless, when the price rallies or falls beyond its standard deviation post-earnings, it often returns to its initial price. We will give it enough time and see what happens. May time and our favourite goddess, Theta, be on our side.

Dozer Fact: We're set to revive our chat feature to announce investment ideas more timely since the processing time for articles often exceeds the trade execution window.

We run, adjust, and verify all numbers ourselves. We delve deeply into financial reports and study them thoroughly. Public data services like Factset, Koyfin, or Ycharts often provide unadjusted or non-meaningful time series data; the real substance cannot be found there.

3.1 Trade Entry - Aug 2, 2023

We're selling a neutral risk-defined strangle at strikes 15.00 and 18.00, with wings at 10.00 and 23.00, maturing on Sep 15, 2023. Break-even points are at 12.50 and 20.50.

The options chains are relatively liquid; the bid and ask spread is wide, and we got filled slightly below mid-price.

Total: 2.64 Credit.

3.2 Trade Risks

Price: Earnings are released in less than a week. The probability of the price approaching one of our break-even points fast is moderate, but we believe in countermovements.

Volatility: The risk of implied volatility expanding beyond its current high level is moderate to low. Following the earnings release, we expect it to deflate.

Assignment: The assignment risk for the short call is low. It is out of the money at the time of the trade, and the borrowing cost for short selling has fallen from 130% to 50% in the last two months, meaning the counterparty should not have too much interest in exercising early.

4. Expected Value & Conviction

The expected value (EV) indicates the expected profit (or loss) if you make the same trade indefinitely.

Expected Value = (Probability of Profit * Expected Profit) - (Probablity of Loss * Expected Loss)

We aim for a positive EV after careful macro, micro and technical analysis, generating the edge through proactive trade management and market probability probing.

4.1 Expected Value For Risk-Defined Strangle

4.2 MacroDozer Conviction

Broker data at maturity shows a possible maximum profit of 264 and a maximum loss of -236. MacroDozer Conviction secures 50% of the maximum profit at early trade close, with a 63% chance of success, resulting in a positive expected value on equity of 17%.

Beyond Meat is suffering from weak demand and financial difficulties.

Despite losses and declining sales, it is valued at nearly 3x the industry median.

To improve sales, BYND needs more investment in R&D and marketing.

Loss-making operations will likely be financed by the issuance of new diluting shares ($200 million).

A neutral risk-defined strangle is what we feel comfortable with.

5. Final Chapter

Expect updates on BrainDozers within 4-6 weeks. We use the exact headline ending with (+/- xy%) and mark the cover cartoon with a red CLOζED stamp. This way, the performance is easy to track.

We do not send BrainDozer updates via email unless you specifically ask for them here. We want to keep the flow of information short and sweet. However, you can still access a free preview of all updates on MacroDozer as soon as they are released.

My name is Juri von Randow. You can find me on the top banner to the right, MacroDozing like there's no tomorrow. (Email version only.)

Feel free to pass me on. Warm regards.

All BrainDozer articles are purely educational; they are not tailored to any particular individual or portfolio and do not constitute investment advice. Let us know if you are interested in implementing any of our ideas. Perhaps we can help or point you in the right direction.