BED BATH & BEYOND: Delayed Fireworks 2023

If dilution is your guilty pleasure, do not inhale.

Executive Summary

Short squeeze vs. long pump.

We rocket, orbit, dilute: when the briefcase lawyer trumps the gunman.

Are store closure lists more powerful than gravity?

We might find out at The City’s next paint party.

1. Why Do I Care Right Now?

If this is the ninth time in twenty-four months that a short squeeze or long pump has hit you, realize that this may be your last chance to dump additional shares to old-fashioned short sellers or high-rolling retail rebels.

Fortunately, Bed Bath & Beyond's management has ensured it can do just that. Up to five times the current free float, six hundred million additional shares want to be thrown into the market as long as the music plays. Who cares about dilution when the rocket is on fire for the big finale; not even Richard Brandson seems to be going for orbit anymore.

These ‘blank check’ At The Market Offerings, where financial advisors try to place new shares smoothly into rallies - $150 million per assignment for BBBY - are extreme measures that we often see in the early stages of (bio)tech companies—raising money as a major pillar of the business model. At the same time, revenue or profitability seem to be vague ideas to be found somewhere in the distant future. Typical for young and upcoming, but also outdated or failing businesses.

On the debt front, Lazard is helping convert over a billion dollars worth of senior notes into shorter-dated convertibles; why not when shareholders seem to be hoovering it all up?

What a party. Reminds me of those demolition paint parties in London where anything goes. Couplings, meds, tunes & colors. Pick a room, find your best friends in action; look for support, discover your most conservative associates living the liberal. Color as a rebase. I am just happy I didn't inhale.

Back to BBBY's I'll-Do-Anything-To-Survive theme party. Again, a lot of colorful rebasing going on here; take the magic brush and apply the financial engineering filter, add a few management stock promotion skills and an easily impressed and playful retail prey, and you've got a New Year's Eve party that seems never to end.

The situation is ludicrous, and we want to be part and play. The last three weeks have been boring, and now, with high implied volatility and expensive option prices in the house of BBBY, we can finally structure a trade you can't refuse. We want to be like the briefcase lawyer who can steal more money than the gunman. Resolutions 2023.

2. Useful Background Information

We were able to close a BBBY position back in September 2022 successfully. Not much has changed in the meantime about the company’s situation, except there wasn't enough time to get the numbers straight for the last earnings call, and management seems to be still fiddling around with those store closure lists.

Feel free to check out our first BBBY BrainDoζer close below.

3. Trade Execution

Since we are unsure where the short squeeze will end and how long it will take to get back to our temporary base of 2, we have eliminated the upside risk by going long the call strike at 3. This will also hedge against a potential takeover bid that we consider unlikely.

If the price stays elevated for longer, we either let the trade expire or add more credit and extend it to the next month if feasible. BBBY seems to have enough cash to survive another two or three quarters, and current share price levels will help fill the war chest via the At The Market Offering agreement with their financial advisors.

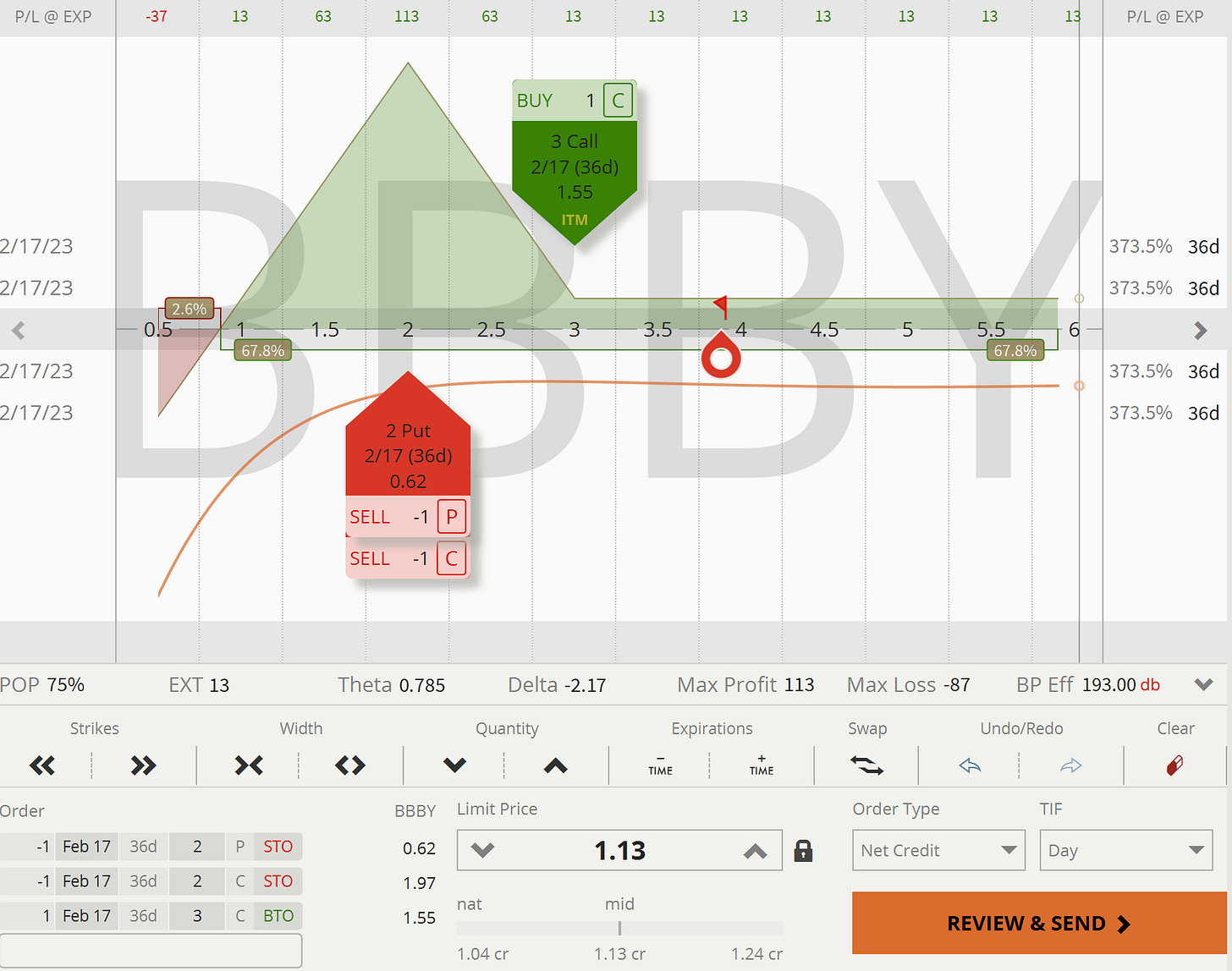

We are selling a bearish straddle at 2, with no downside wing and 0 as our downside risk, and one upside wing at 3, expiring Feb 17, 2023.

The break-even to the downside is 0.93; there is no risk to the upside.

3.1 Trade Entry - Jan 12, 2022

Yesterday, we got filled at 1.07, and today at 1.15. We take the lower number for the return on risk capital calculation.

Total: 1.07 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDoζer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.