AMC ENTERTAINMENT: Risk-Free Trading (UPDATE)

Monkeys, Drawdowns, Peanuts?

Executive Summary

When you monkey around with trade size.

Four is close to risk-free; three is not!

The infinity trade is coming back to earth.

1. Recap Situation

You may have noticed little activity at the Doze lately. The reason is simple: we have been busy investigating and dealing with arguably one of the most extreme events in American-style options trading. The experience taught us a lot and was humbling, to say the least, mainly because we had structured our products to be risk-free at maturity and sized them accordingly, namely a bit larger than usual. The last few weeks wouldn’t have been so intense if we had been more prudent. However, the lessons learned from the first real drawdown under pressure are invaluable. We have developed new products, forged new strategies to contain future explosions of implied volatility and option assignment risks, and generated new, improved hedging principles against transient and sudden directional changes in price from trade start to trade expiration. As a result, we now feel more vital than ever; we are warmed up and stretched: Bring it on, 2023!

To be clear, the AMC trade we have published is solid and safe. As long as you weren't too greedy with the position size, you will come out unscathed and most likely make a substantial profit. However, we at the Doze also established a straddle one strike lower; we sold not only the 4s but also the 3s. A few days later, a second short squeeze occurred in AMC and other meme stocks, causing the short-sale borrow rate to soar from 100% to over 400%. Short-sale lending rates typically range from 0.25% to 3.0% per year, and interest rates on borrowed AMC shares suddenly rose to 1.1% per day.

As a result, brokers assigned deep-in-the-money short calls like mad, mainly at the strike price of 3 and below, because other market participants seemed to prefer lending shares for 1.1% interest per day instead of holding the call options. Not necessarily the most rational effort because those high, hard-to-lend rates are priced into the call options anyway. You'd be better off closing out your long calls unless you sincerely believe AMC is a promising long-term investment with its unlimited dilution and potential bankruptcy around the corner.

AMC Shares - Cost of Borrowing for Short Selling

Occasional assignments are not necessarily a big deal. You buy back the assigned short stock and resume the corresponding short call position. There may be transaction costs, bid-ask spread slippage, and minor mispricing of the stock relative to the option premiums. However, with a highly liquid AMC and very elevated implied volatility, it might even be possible to reverse assignments for a small profit.

Now comes the part that could prove inconvenient. Your broker might approach you at some point during your daily morning routine of reversing option assignments and remind you of the extremely high daily borrowing costs you will have to pay no matter how quickly you flip the trade. He might also ask you not to re-enter the short call position at strike 3 to avoid future assignments and suggest you switch to a short call position at strike 4 instead. This switch will better protect you from another short squeeze, too. However, you will have to give up a significant portion of your potential future profit, and it will take longer to recover from a theoretical drawdown when implied volatility finally declines, and your stock price starts moving back in the desired direction.

Fast-moving markets and the sheer explosion of already very high implied volatility gave the situation an additional edge, driving up the initial value of straddles sold. Not ideal when you are aiming for premium deflation.

Check out the original BrainDoζer below.

2. Why Now?

In addition to our little trading adventure, we would also like to update you on recent affairs around AMC briefly. A lot is happening; the most recent developments further strengthen our AMC trade rationale.

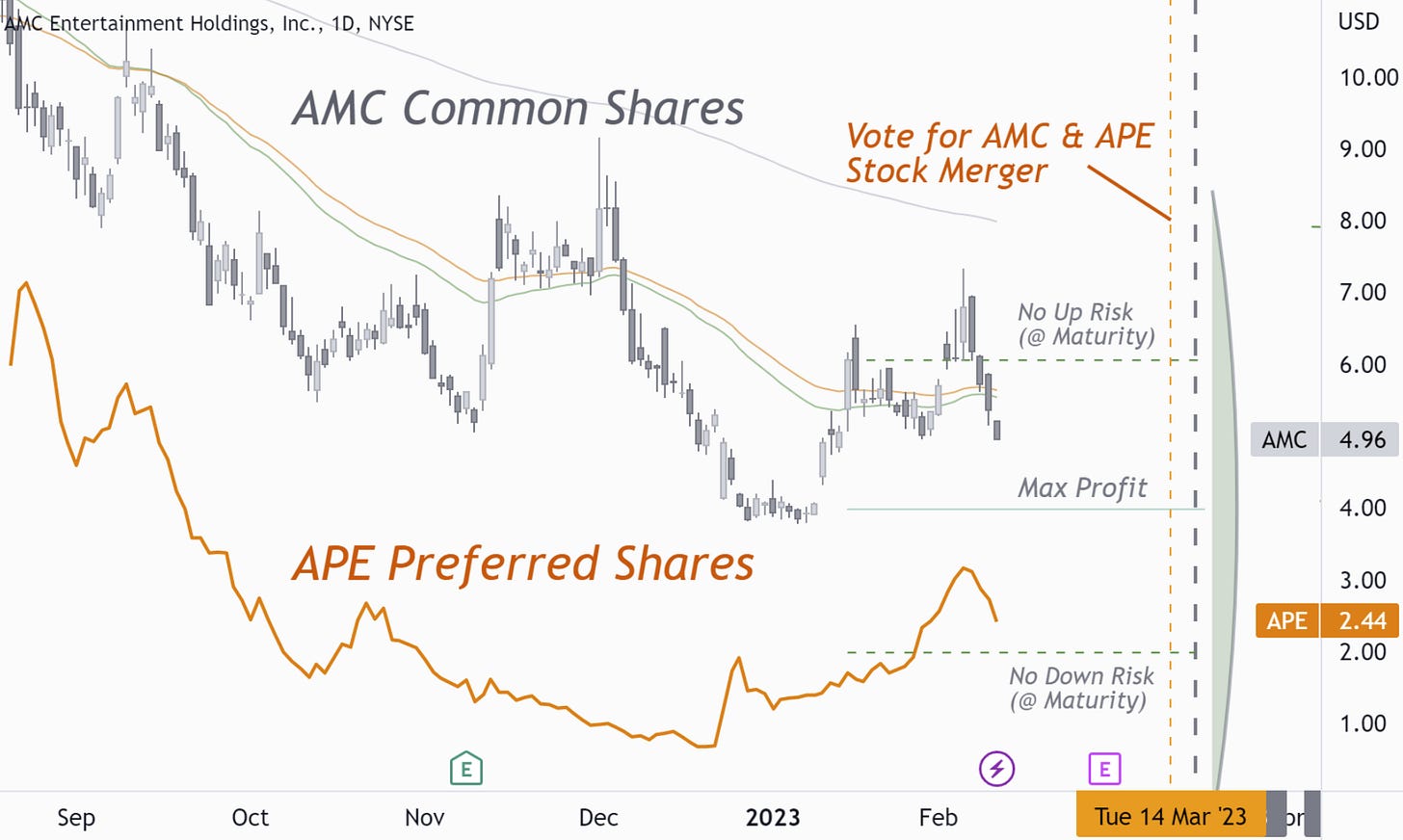

The upcoming March 14 vote to combine AMC common and APE preferred shares on a one-for-one basis will likely result in a new AMC stock price somewhere in the middle.

(4.96 AMC + 2.44 APE) / 2 = 3.70.

Although AMC common stock and APE preferred stock are technically the same thing, they never traded level because management was able to dilute APE but no longer AMC since AMC's securities supply via the at-the-market offering agreement was already exhausted in December, so diluting APE was the only solution to survival.

Once the vote is completed, the new AMC shares will dilute further.

2.1 AMC & APE: Short-Squeezed and Back on the Road to Convergence?

2.2 Trade Entry - Jan 19, 2023

Total: 2.03 Credit.

2.2 Trade Spot - Feb 10, 2023

Total: 1.70 Debit.

The spot paper return on this trade is

2.03 - 1.70 = 0.33

The risk equity at maturity is 0. However, due to the explosion in share price, implied volatility, and high borrowing rates on short sales, the total premium rose to 2.25 for a few days, resulting in a maximum risk capital of 0.22, leading to a spot return on equity of

0.33 / 0.22 = 150%

For instant trade updates, early ideas, or other magic, join our Early-Dozer Live Chat.

If you want the app to notify you of new messages, you'll need to opt-in by posting something in reply.