AMC ENTERTAINMENT: Risk-Free Trading (+395%)

Exit from a World of Insanity

Executive Summary

Never before have we had to fight so hard to reach the finish line.

Option assignments, short sellers, and inflated position sizing made for a remarkable three-way performance.

With the beast overpowered, more time will go back into new trading ideas and the set-up of an easy-to-follow MacroDozer Investor portfolio.

1. Recap Situation

If you think you've peaked and are toying with the idea of dividing returns by zero risk on your way to infinity, keep in mind that there could be explosives hiding around every corner that will keep you busy until maturity in case the monkeys do not.

The past eight weeks have been a flurry of internal activity at the Doze. Fighting assignments and short sale fees beyond the 700 per cent mark, restructuring and reducing oversized positions resulting from squeezy options assignment reversals, and watching kamikaze reddits slaughter overconfident semi-pros.

AMC Shares - Cost of Borrowing for Short Selling

Retail weapon of choice: Cheap out-of-the-money calls. Semi-pros’ AMC/APE conversion trade: Death by multiple squeezes (AMC) & dilution through management and privileged insider investor (APE).

What a masterpiece of illusion, with the entire investor base giving their last blood so that a handful of AMC aristocrats can get fed and fat. Here we are, trying to be funny. If any severe investors are left among the AMC/APE speculator crowd, I suggest putting down the OxyContin, and start selling!

Thank goodness our options product was risk-free.... not. Check out the update to the original BrainDozer below.

2. Why Now?

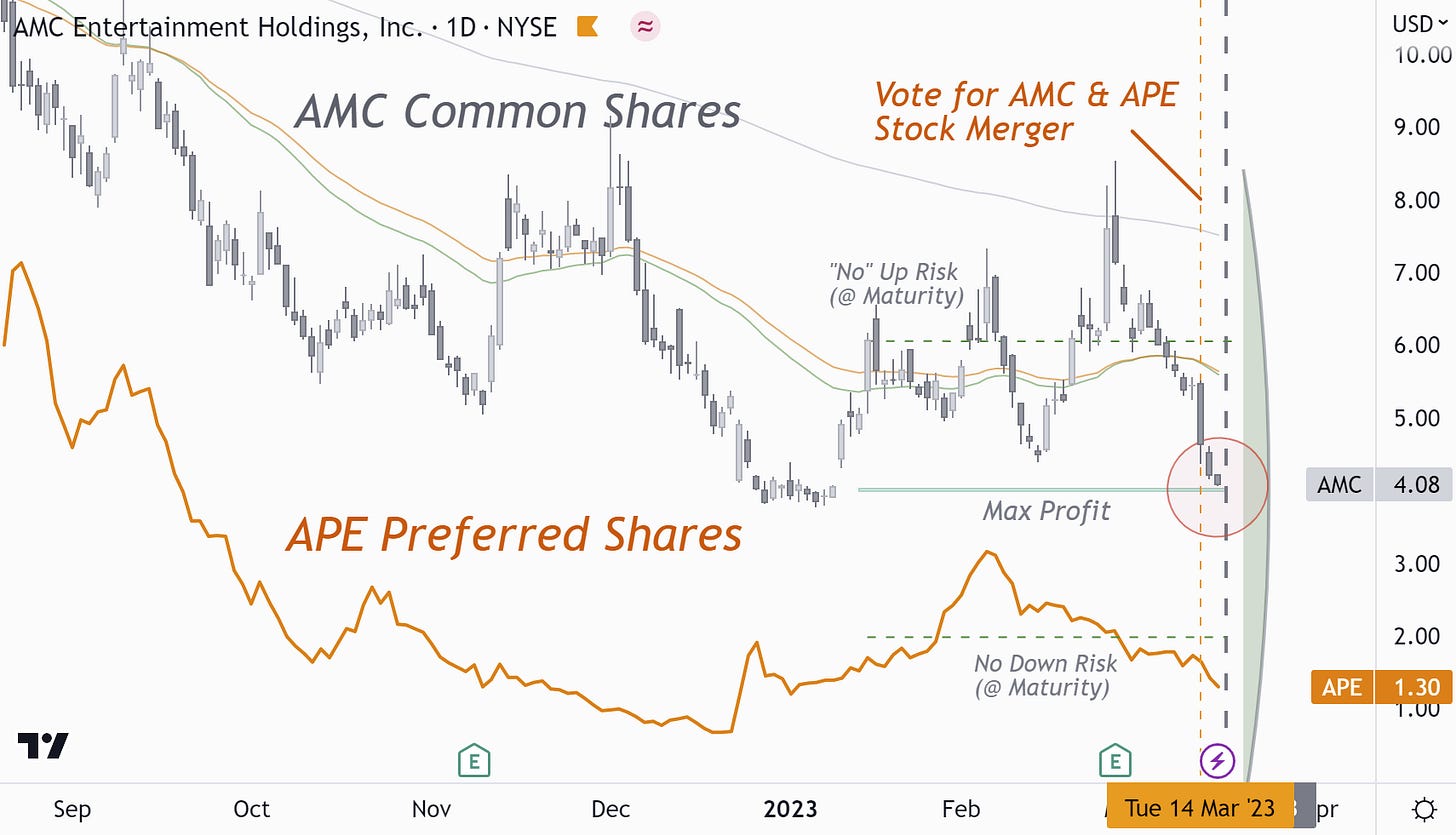

In the end, our trigger of last resort kicked in. The plan from the beginning was to bet on a falling AMC share price, and the ultimate catalyst, we suspected, shall be the vote on the AMC/APE share merger three days before maturity. This has now materialized, and we are happy to close the trade just before expiration.

The emperor is not wearing any clothes; who would have thought…?

Full disclosure, we at the Doze had to de-risk parts of our positions a little earlier. We monkeyed around with trade size and made additional trades by selling straddles below strike four, a volatile yet valuable lesson. That said, with some MacDoze trade repair sorcery and on-risking a couple of weeks and days before the vote, we could squeeze out an honourable return on nearly all accounts; a tremendous win. We also learned some priceless moves right off the streets for future insanity plays.

3. Trade Execution

The short calls, strike four, were assigned seventeen times. Sometimes only a fraction, sometimes the entire position; on average, roughly fifty per cent, seventeen times.

When the stock price went up, we usually had to take a cut; when it went down, we gained a little on reversal. We are taking the prudent approach of including a cost of two cents per assignment reversal for the return on risk capital calculation below.

3.1 Trade Entry - Jan 19, 2023

Total: 2.03 Credit.

3.2 Trade Exit - Mar 16, 2023

Total: 0.32 Debit.

3.3 Trade Return

The absolute return on this trade is

2.03 [credit trade entry] - (0.32 [debit trade exit] + 17 [assignments] * 50% [average assignment on position] * 0.02 [prudent cost of reversals])

→ 2.03 - (0.32 + 0.17) = 1.54

At trade entry, the risk at maturity was 0. However, due to squeezes in price, implied volatility and short sale borrowing rate, the total premium temporarily rose to 2.25, resulting in a momentary theoretical risk of 0.22.

We add the additional cost of each assignment reversal, resulting in a total risk capital of 0.22 + 0.17 = 0.39, which leads to a return on equity of

1.54 / 0.39 = 395%

Well done on all the lunacy, provided you stuck to the MacroDozer trade sizing without preventive de-risking and kept a decent amount of patience.

3.4 Trade Size

If you want to risk, e.g. 5% of your equity per trade, but your broker quotes zero risk, consider a potential further expansion/ explosion of implied volatility and assignment costs as your risk base, if feasible.

A prudent trade size approach in this particular case, with an equity base of, e.g. $100,000, would have been

($100,000 * 5%) / (0.39 [risk] * 100 [options multiplier]) = 128 Contracts

what a deal!